This Brilliant Strategy Could Pay Off Big-Time

Have you ever watched a webcast or promo of a new technology and come away with more questions than answers? I definitely have. The biggest question I often have is: How can this be applied to my company?

Explaining this in a general demo, especially with complex artificial intelligence (AI) software, is difficult. Palantir Technologies (NYSE: PLTR) has a solution, and it’s pretty brilliant.

What is Palantir AIP?

Palantir’s latest software is its Artificial Intelligence Platform, or AIP for short. Here’s the 30,000-foot view. It immerses the AIP software into a company’s existing systems. Now the data is all in one place rather than multiple silos. Next, AIP creates a complete model of the organization’s business functions. The software allows the customer to use large language models to explore processes, examine potential actions, and ultimately make better decisions. AIP is available for governments (defense) and the private sector.

Here are two examples that Palantir gives. Say there is an army unit in the field near hostile territory. The commander notes that the enemy is amassing weapons nearby. Using AIP, the commander can model scenarios, predict likely enemy formations, and see what assets are available to repel an attack. Next, imagine a private sector company with a warehouse in the path of a hurricane. The logistics department can model the impact of a warehouse shutdown and see which alternative sites are the most cost-effective for getting customers their orders.

Palantir’s strategy for bringing this complex software to the market is through what it calls “boot camps.” Unlike demo videos, the five-day workshops allow potential customers to get hands-on experience and solve problems specific to their companies. This is clearly a more effective way to introduce a product. Palantir has completed boot camps with 915 organizations since mid-2023; it closed 136 deals in the first quarter 2024 and its U.S. commercial customer count grew 69% year over year in the quarter.

Is Palantir stock a buy now?

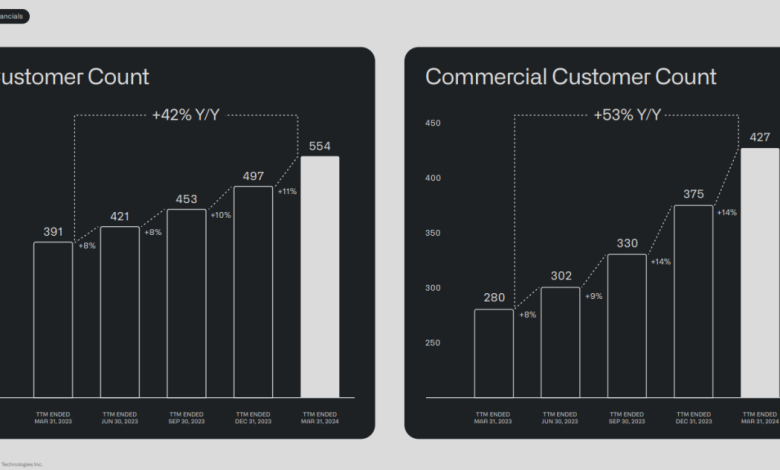

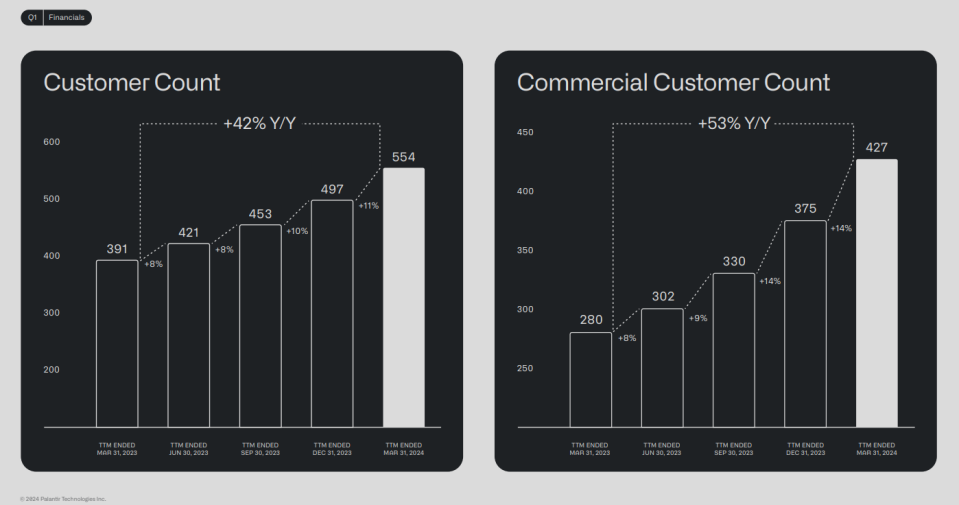

There was much to like in Palantir’s Q1 earnings release and long-term trends. Sales increased 21% year over year to $634 million, a slight acceleration over the 20% growth posted in Q4 2023. More importantly, customer counts continue to expand rapidly, as shown in the charts below.

Growing the customer base is critical because Palantir’s revenue model is recurring, i.e., customers pay for the software annually. Once Palantir gains a customer, it can reap the rewards for years.

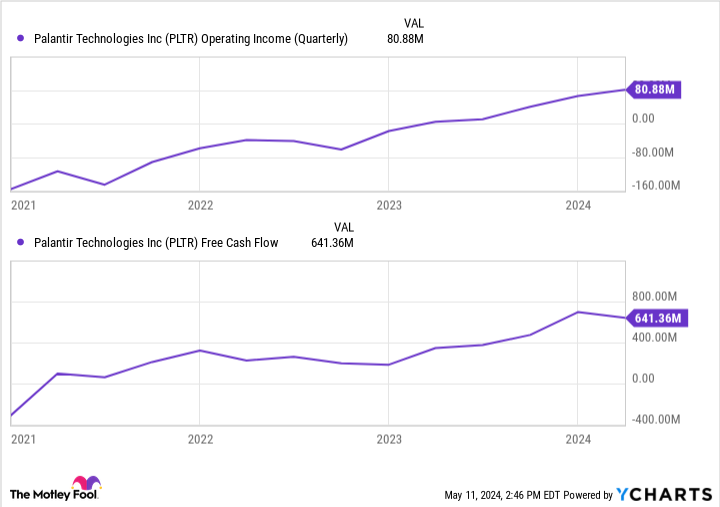

Palantir was often criticized for its lack of profitability after going public in 2020, but those days are behind it. The company reported its sixth straight quarter of generally accepted accounting principles (GAAP) net income and fifth straight quarter of GAAP operating income. It also generates tons of free cash flow (FCF). As depicted below, operating income and FCF are ramping up significantly.

Palantir used the profits and positive cash flow to build a fortress-like balance sheet, with $4.4 billion in current assets versus $751 million in current liabilities and no long-term debt. Responsible cash management provided $43 million in interest income in Q1, a 7% cherry on top of its $634 million operating revenue.

The most significant risk for Palantir shareholders is the valuation. The stock trades for 20 times sales. Even though this is less than fellow growing software-as-a-service (SaaS) company CrowdStrike at 25, and similar to Datadog at 19, it isn’t cheap. Investors are enthusiastic about AI companies, and there could be a pullback. Because of this, dollar-cost averaging is a terrific risk-mitigation buying strategy as you’d be buying shares with a set amount invested at a recurring interval.

With its unique sales strategy, positive customer growth trends, and excellent financials, Palantir looks like a long-term winner in software and AI.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Bradley Guichard has positions in CrowdStrike. The Motley Fool has positions in and recommends CrowdStrike, Datadog, and Palantir Technologies. The Motley Fool has a disclosure policy.

Palantir: This Brilliant Strategy Could Pay Off Big-Time was originally published by The Motley Fool

Source link