Good sides apart, new duty regime worries trade bodies

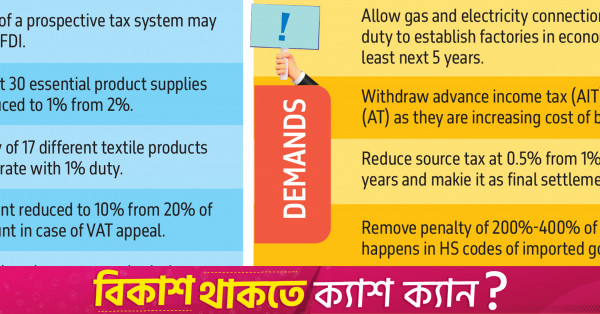

Infographics: TBS

“>

Infographics: TBS

Leading trade bodies found some solace in the proposed budget for the upcoming budget with measures such as the reduction of the required deposit for VAT claims from 20% to 10% for appeals and allowing the import of 17 textile goods at a reduced rate.

However, they also identified several challenges that could potentially harm industries, businesses, investments, and employment.

Their concerns include the imposition of a 1% import duty on capital machinery and construction materials for all industries in the economic zones, the government’s increasing reliance on bank borrowing, the lack of assurances for a stable energy supply, and the failure to treat the advance income Tax (AIT) as the final settlement, if not abolish it altogether.

Also, though not part of the budget, the government’s decision to withhold utilities and bank loans from new factories located outside the economic zones is another significant issue pinpointed in their separate post-budget briefings yesterday.

If these concerns are not addressed, leading businesses warn that both domestic and foreign investments will be discouraged.

BGMEA, BKMEA & BTMA

Textile and garment owners have urged the government to delay the proposed duty policy in economic zones for five years. They also called for allowing gas and electricity connections and approved loans for factories outside industrial zones.

In a joint press conference yesterday, they warned that if the government does not change the policy, it will severely impact investments and hamper employment generation.

BGMEA President SM Mannan Kochi said, “If the government does not provide utility connections and banks do not approve loans for these factories, where will they go? Additionally, it will be difficult for small entrepreneurs to set up factories in economic zones.”

He recommended creating a fund for small and medium entrepreneurs with minimal interest rates for at least 15 years, saying, “Otherwise, small entrepreneurs will struggle to grow due to high interest rates and business establishment costs.”

He also urged the government to withdraw the proposed 200-400% penalty for unintentional HS Code mismatches during import.

BKMEA Executive President Mohammad Hatem said they asked the government to reduce the source tax from 1% to 0.5% and to consider it as the final settlement but the budget proposal did not address these demands.

“We continue the same demand,” he said.

BTMA President Mohammad Ali Khokon highlighted the severe gas and energy supply shortage affecting the textile sector, impacting production and increasing yarn and fabric imports.

“If Petrobangla would supply at least 3,000 million cubic feet per day to the national grid, we would be able to survive,” he added.

FBCCI

The Federation of Bangladesh Chambers of Commerce & Industries (FBCCI) has proposed keeping duty-free import facilities for capital machinery and construction materials in economic zones and hi-tech parks.

They also requested the removal of advance income tax and advance tax at a press briefing yesterday.

The trade body’s President Mahbubul Alam said, “If the [previous] facilities are not available, it will discourage foreign investment in these special regions and [perhaps] send the wrong message to foreign investors.”

Mahbubul Alam proposed extending the previous facilities of 0% import duty for economic zones for at least five to ten more years.

He said foreign investment is attracted to economic zones due to zero duty and that these benefits should be maintained for another 5-10 years.

“The economic zone is not yet fully developed, and both local and foreign investors need assurances of long-term benefits to remain interested in investing,” he added.

He suggested focusing on foreign financing instead of local banks to meet the budget deficit. Alam also pointed out the challenge of reducing inflation from 9.89% to 6.5%.

He also recommended raising the tax-free income limit from Tk3.5 lakh to Tk4.5 lakh to account for inflation.

Alam stressed the need for good governance, proper monitoring, clear direction, and planning to implement the budget effectively. He also called for strengthening the partnership between the public and private sectors.

Bangladesh Computer Samity

The Bangladesh Computer Samity has called for the withdrawal of an additional 5% duty on laptop imports, proposed in the budget.

“Laptops are essential tools for everyone, from freelancers to outsourcing professionals,” said Subrata Sarker, president of the Samity, during a press conference yesterday.

He urged the government to reconsider the additional duty, noting laptops’ importance in achieving the government’s $5 billion export targets and their recognition as educational tools.

Currently, importers face a 31% total customs tax on laptops, including a 5% duty. The proposed budget would increase this duty to 10% but exempt VAT, reducing the total tax incidence to 20.5%.

Sarker also said it is necessary for hardware for IT operations and urged the inclusion of hardware services in the definition of IT-enabled services. Additionally, he requested the withdrawal of the proposed 15% duty on printers and toner cartridges, which would lead to a total tax incidence of 26%.

He said that without hardware, IT operations are impossible. While robotics and AI have been included in IT-enabled services, hardware services have been neglected.

“It is crucial to include hardware services in the definition of IT-enabled services to continue developing the IT sector,” he added.

He also sought the withdrawal of the proposed 15% duty on printers and toner cartridges, stating the duty will result in a total tax incidence of 26%.

Tour Operators Association of Bangladesh

Tour Operators Association of Bangladesh (Toab) has called for the removal of the 15% tax imposed on the tourism sector in the FY25 budget.

Toab President Md Rafeuzzaman made the demand during a meeting with the FBCCI President Mahbubul Alam following the budget announcement on 6 June.

“Tour operators cannot directly collect VAT from tourists, as hotels already pay VAT to the government on food and accommodation,” said the Toab president.

He said if VAT is imposed on us separately, the tourism and tour operator sectors will suffer. “That is why we strongly urge the government to withdraw the tax levied on this sector.”

Dhaka Chamber of Commerce & Industry (DCCI)

DCCI President Ashraf Ahmed on Thursday welcomed the prospective tax system for FY25 and FY26, calling it a positive step for boosting foreign direct investment.

He warned that if government bank borrowing increases, private sector credit flow may shrink. Although the government’s borrowing target is 11.82% lower than the previous fiscal year, it remains high.

He praised the government’s efforts to increase revenue while controlling inflation and reducing the budget deficit. He highlighted the reduction of import duties on nearly 30 essential products as a good move.

He suggested a separate tax code for the SME sector due to the complexity of the current tax system. He also noted that the budget deficit target of 4.6% is lower than in previous years.

Ahmed acknowledged that while some taxes and VAT have been reduced and others increased, the overall impact on businesses should not be too harsh. He stressed the importance of implementing the budget’s good initiatives.

He mentioned the conditional 2.5% corporate tax reduction for both listed and non-listed companies as a positive change.