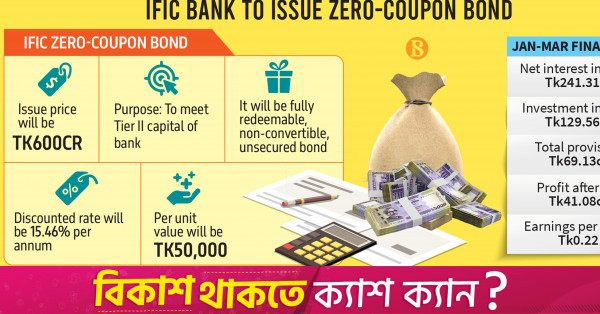

IFIC Bank to issue Tk600cr zero-coupon bond

In a stock exchange disclosure on Thursday, the lender said the zero-coupon bond will be fully redeemable, non-convertible, and unsecured

Infographics: TBS

“>

Infographics: TBS

IFIC Bank has decided to issue a zero-coupon bond to collect Tk600 crore to meet the Tier II capital requirement as per BASEL III guidelines.

In a stock exchange disclosure on Thursday (13 June), the lender said the zero-coupon bond will be fully redeemable, non-convertible, and unsecured.

With this move, the lender has backtracked on its August 2022 decision to issue a non-convertible coupon-bearing subordinated bond of Tk500 crore.

The private sector lender is a guarantor of ‘IFIC Amar Bond,’ which raised Tk1,000 crore for Sreepur Township.

The bank’s latest shift has been prompted by the requirement that 50% of the bond issuance had to be distributed to entities other than banks and financial institutions, according to the bank’s officials.

Given that the unit value of the bond was set at Tk1 crore, it was impractical for anyone other than banks and financial institutions to purchase it, they added.

As a result, the bank revised its decision and opted to issue zero-coupon bonds to retail customers instead, making it more accessible to a broader audience.

The discount rate of the zero-coupon bond will be 15.46% per annum, and the lot value will be Tk50,000.

It will have multiple maturities, meaning investors will get back their money in tranches starting from the first year.

IFIC Bank’s officials mentioned that this bond will be issued with a total amount of 1.20 lakh lots and every lot will be divided into 14 units, which will mature over time.

A coupon bond, also known as a bearer bond, is a debt obligation that includes coupons. These coupons represent semiannual interest payments made to the bondholder. Each coupon can be detached and redeemed for its interest payment when it is due.

On the other hand, a zero-coupon bond is a debt security sold at a deep discount and does not pay periodic interest.

Instead, it provides profit by redeeming at full face value upon maturity. The investor earns the difference between the discounted purchase price and the full-face value at maturity.

During the January-March quarter, the consolidated net interest income of the lender stood at Tk241.31 crore, compared to Tk199.89 crore in the last year’s same period.

During the quarter, its consolidated investment income stood at Tk129.56 crore, higher than Tk104 crore a year ago.

IFIC Bank made a total provision of Tk69.13 crore in the January- March quarter of 2024, up from Tk36.16 crore one year ago.

In the first quarter, the lender achieved a consolidated profit after tax of Tk41.08 crore, down from Tk62.22 crore compared to the same period of the previous year. Its consolidated earnings per share stood at Tk0.22, compared to Tk0.34 a year ago.

On Thursday, the bank’s share price increased by 2.38% to Tk8.60 on the Dhaka Stock Exchange. It recommended a 5% stock dividend for its shareholders for 2023.

As of 31 May 2024, sponsors and directors jointly held the bank’s 6.14% share, while the government held 32.75%, institutions 21.96%, foreign 0.65%, and the general public 38.50% shares.

In 1986, the bank was listed on the Dhaka Stock Exchange. It has 187 branches and 1,208 sub-branches as of 31 March 2024.