Yeakin Polymer must transfer ownership by 15 July

Infographics: TBS

“>

Infographics: TBS

The Bangladesh Securities and Exchange Commission (BSEC) has extended the deadline for Yeakin Polymer’s share transfer to Kapita Packaging Solutions Limited for the second time.

Now, the publicly listed poly sacks manufacturer has to transfer its sponsors and directors’ stake to the new owner within 15 July following the rules.

The company’s sponsors and directors hold 30.52% stake in the company.

BSEC officials said this is the final extension and an ultimatum for the company to complete the ownership transfer as investors are not getting any returns on their investments in the company.

Yeakin Polymer’s Chairman, Quazi Anwarul Haque, told The Business Standard that they could not complete the stake transfer within the stipulated time because of various reasons.

Complexities involved with the process hindered the share transfer within the stipulated one month time, he explained.

“We hope to complete the whole process within the deadline, as a big portion of the process has been already completed,” he added.

On 12 May 2022, the Yeakin Polymer got approval from the BSEC for the share transfer. This decision followed a significant surge in the company’s share price in January 2022, where prices rose by approximately 140% due to issues surrounding the ownership transfer.

However, it could not meet the first deadline despite obtaining regulatory approval.

On 21 December 2023, they were granted an extension for the first time, but were unable to meet the deadline. The company’s share price also surged this time.

On 9 June 2024, the company received a fresh one-month extension from the BSEC to complete the share transfer process.

In May 2022, the commission allowed Kapita Packaging to take over Yeakin Polymer, which has been in a dire strait since 2018.

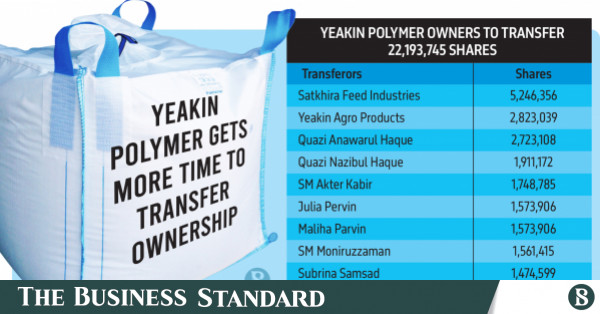

According to the share purchase agreement between the two parties, Yeakin is supposed to sell 30.114% or 22,193,745 sponsor-director shares to Kapita Packaging at a face value of Tk10 per share.

The BSEC had issued its go-ahead to the depository service provider, bourses, and concerned stockbrokers for unblocking the 30.114% stake of Yeakin in the depository system and transferring the shares to Kapita Packaging.

However, after the share transfer, the concerned entities will again have the shares blocked so that the new owner cannot sell them without prior regulatory approval.

Yeakin owes nearly Tk34 crore to various lenders and the company’s outgoing sponsor-directors must obtain no-objection certificates (NOCs) from those lenders before selling the shares.

After the share transfer is over, Kapita Packaging will nominate its directors for the new board, and welcome other shareholders to the board if they have at least a 2% stake in the company.

It will also ensure the resumption of production within two months and further take care of its dues.

Meanwhile, Yeakin’s share price rose several times at the Dhaka Stock Exchange (DSE) riding on the news of ownership transfer and rumours surrounding the resumption of the company’s production.

On Sunday, the share price of the company closed at Tk21.40 on the Dhaka stock exchange.

The company raised Tk20cr in 2016 through an initial public offering (IPO) for business expansion. However, the company’s business declined after the government’s move to promote jute sacks over polymer ones.

The company paid a 1% cash dividend only once since listing. Now, the company is trading in the ‘Z’ category, downgraded by the stock exchanges in February.

During the July-March period of 2022-23 fiscal year, its net loss stood at Tk6 crore.

At the end of March last year, its loss per share was at Tk0.80, while net asset value per share at Tk5.35.

As of 31 May 2024, sponsors and directors jointly held 30.52%, institutions 18.85%, and general shareholders held 50.63% shares of the company.