Current pension scheme not financially sustainable: Govt clarifies Prottoy introduction

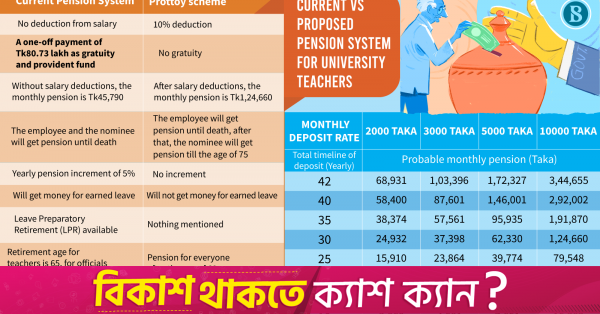

Under the Prottoy scheme, the relevant institution or organisation will deduct either 10% from the employee’s basic salary or up to Tk5000 [whichever is lower], and the institution will contribute a matching amount

Infographic: TBS Creative/Duniya Jahan

“>

Infographic: TBS Creative/Duniya Jahan

The current pension system for university teachers, which operates under an unfunded defined benefit system, is unsustainable, the government said today (2 July) clarifying the introduction of the new Prottoy scheme.

“The unfunded defined benefit is not financially sustainable in the long run. In contrast, the funded contributory pension system [Prottoy] will create a fund based on contributions and investment returns, providing a sustainable pension system for the long term,” reads a press release issued by the Universal Pension Authority.

It mentioned a similar funded contributory pension system that has been in operation in neighbouring India since 2004.

The current government pension system operates under an unfunded defined benefit system where all pension expenses are met from the allocated budget.

Starting 1 July, a funded defined contributory pension system is being implemented, similar to other countries, where a specific amount is deducted monthly from salaries.

“Under the Prottoy scheme, the relevant institution or organisation will deduct either 10% from the employee’s basic salary or up to Tk5000 [whichever is lower], and the institution will contribute a matching amount,” reads the release.

Both amounts will then be deposited into the officer/employee’s corpus account.

The press release says the new pension scheme is aimed at providing a sustainable pension system for people from all walks of life.

“The Prottoy scheme has been introduced for autonomous, semi-autonomous, and state-owned enterprises and their organisations,” it reads.

Currently, there are 403 autonomous, semi-autonomous, and state-owned institutions. Among these, approximately 90 institutions have a pension system [the previous one] in place.

The release says the remaining institutions are covered by the Contributory Provident Fund (CPF), where employees receive a one-time payment for gratuity instead of a pension.

Besides these institutions, a vast number of the general population outside governmental, autonomous, semi-autonomous, and state-owned entities do not have access to a structured pension system, it said.

The release clarified that the government introduced a universal pension scheme through the Universal Pension Management Act, 2023, Section 14(2), to develop a robust pension structure for people from all classes and professions.

All employees joining autonomous, semi-autonomous, and state-owned institutions after 1 July will be mandatorily included under the Prottoy scheme.

“The finance minister has explicitly mentioned in the FY25 budget speech that government employees joining on or after 1 July 2025 will also be covered under the universal pension,” it said.

The release also states that teachers and staff employed until 30 June 2024 will be eligible for the same pension benefits as before.

The introduction of a new pension management system will gradually bring people from all classes and professions into a sustainable social security framework, facilitating financial inclusion and inclusive development, it says.

“If a public university teacher applies through the proper authority and is appointed to the same or a higher position at their own or another university, they will receive service and pay protection and thus will not be considered as a new appointment,” reads the press release.

In this case, they will continue to be covered under the existing pension benefits. Teachers and staff at public universities who are newly appointed after 1 July will only be included under the Prottoy scheme.

The press statement further states that university teachers will retire at 65 and receive a lifetime pension from that age, even though the Universal Pension Management Law states that pension benefits start from the age of 60.

“The government will make necessary amendments to the law to accommodate this,” it reads.

According to the UPA press release, pensioners receive a lifetime pension under the existing system. In the event of a pensioner’s death, their spouse and disabled children also receive a lifetime pension.

The new pension system will also provide a lifetime pension for pensioners. In the event of a pensioner’s death, their spouse or nominee will receive pension benefits for the remaining time up to 15 years from the start date of the pensioner’s pension.

For example, if a pensioner retires and receives a pension for five years before passing away, their spouse or nominee would then receive a pension for an additional ten years, it adds.