How $10b export data error throws economic assessment off

So, now with the NBR correction, a new shocking reality has hit us hard – our exports are not as much as was touted

Infographic: TBS

“>

Infographic: TBS

The truth is finally out here. Our exports are not as much as they are shown. It is at least $10 billion less.

The mystery of export data mismatch was finally resolved yesterday after the National Board of Revenue (NBR) corrected its estimates of exports it had been erroneously showing inflated for the last few years.

This has thumped down exports figures for the last nine months by a huge $10 billion, showing a negative growth in reality instead of positive growth perceived so far.

It was this far believed that more than $12 billion mismatch between shipment and realised value of exports was because of slow realisation of export receipts. Exporters always doubted the rosy export figures.

So, now with the NBR correction, a new shocking reality has hit us hard – our exports are not as much as was touted.

The latest Balance of Payments (BoP) statement for July-April of FY24 revealed that the financial account swung to a surplus of $2.2 billion, reversing from a historic deficit of $9.25 billion a month earlier. Indeed, the financial account turned positive after two years of being negative.

This shift follows the adjustment of inflated export figures by $10 billion for July-April of FY24, according to the Bangladesh Bank.

Exporters were often blamed for not bringing their export proceeds into the country. Failure to repatriate these proceeds leads to a shortfall in expected inflows, adversely affecting the financial account balance.

However, the reality is that the export figures recorded by the NBR were hugely inflated.

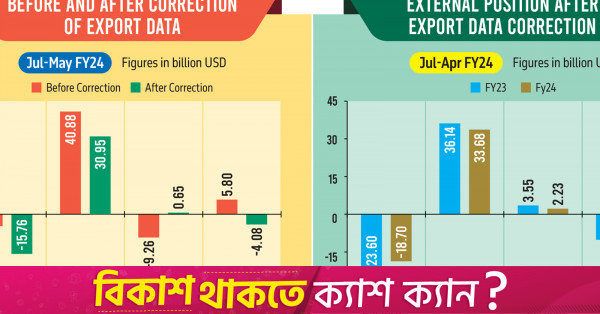

After the major correction, export earnings, which initially showed 5.53% year-on-year growth in July-March, have now turned negative at 6.8% in July-April, according to the latest BoP released on Wednesday on the Bangladesh Bank website.

In July-March of FY24, total exports were registered at $40.8 billion which declined to $30.9 billion after the NBR had corrected the export data entry. In July-April, total exports registered at $33.6 billion, which was $2.4 billion less than the $36.13 billion recorded in the same period of the previous year, according to corrected data.

On the other hand, the negative export growth turned the current account balance to a deficit of $5.7 billion in July-April which previously showed a surplus of $5.7 billion in July-March.

At the same time, the trade deficit, which narrowed to $4.7 billion in July-March, widened to $18.6 billion in July-April following data corrections by the NBR. According to the new calculation, the current account deficit registered $15.7 billion in July-March, as per Bangladesh Bank data.

It is unexpected to have such a major error in significant data, said Dr Ahsan H Mansur, economist and executive director of the Policy Research Institute (PRI).

He said there would be major consequences on two indicators – the export-to-GDP ratio and debt servicing payment calculations – following the revision of export data.

The decline in export calculations will reduce the export-to-GDP ratio and increase the burden of debt servicing, he added.

“While we believed our export performance was good, the data correction reflects that our real performance was poor,” he said.

He said the government should inquire whether the incorrect export entries benefited any individuals or groups as exporters get incentives against export earnings.

How the correction was made in export data entry

The correction was made following widespread criticism regarding the substantial gap of $12.2 billion between the shipment and the realised value of the country’s exports.

The Bangladesh Bank prepared the BoP statement by adjusting the mismatch in export values within trade credit, which is a component of the financial account. As the trade credit showed a $12.2 billion negative in July-March, it affected the financial account, turning it into a deficit and causing concerns for the central bank.

The International Monetary Fund (IMF) also raised concerns with the Bangladesh Bank about the substantial negative trade credit, which has contributed to the financial account remaining in deficit in FY24.

In its second review report on the $4.7 billion loan package, the IMF also addressed significant delays in the repatriation of export proceeds as a major factor behind the large negative trade credit that led the financial account in deficit.

Exporters were also claiming for a long time that the export figures of the Export Promotion Bureau (EPB) were not correct.

Stakeholders say the double counting of exports inflates the country’s export figures, making it difficult to assess the true performance of the export sector.

This misleading data is the result of two different methods of calculating export numbers by the NBR and the EPB.

However, following corrections by both agencies, export earnings now show negative growth.

Explaining the massive change in the financial account, the Bangladesh Bank in its BoP statement mentioned that the NBR revises and provides the export shipment data to the Bangladesh Bank and the EPB by adjusting multiple entries.

A senior executive from the Bangladesh Bank said the NBR is the source of export data and thus bears sole responsibility for the substantial data entry mismatch that has led to the deficit in the financial account.

Efforts to reach NBR chairman Abu Hena Md Rahmatul Munim via phone and WhatsApp messages regarding this issue were unsuccessful.