Three Shariah-based banks account for 36% of FY24 remittances

Bangladesh garnered close to $24b in remittances in FY24

Infographics: TBS

“>

Infographics: TBS

Three Sharia-compliant banks played a key role in remittance growth in the just-concluded fiscal year, contributing a significant 36.13% ($8.64 billion) of the total remittances received, according to central bank data.

Among these banks, Islami Bank Bangladesh facilitated a whopping $6.12 billion in remittances, Social Islami Bank $1.66 billion and Al-Arafah Islami Bank $844 million.

Bangladesh received $23.91 billion in remittances channelled by 61 commercial banks in FY24, marking a 10.66% increase from FY23.

Similar to the last fiscal year, Islamic banks played a significant role in the year before that. During FY23, total remittances through the country’s banks reached $21.61 billion. Remittances through the said Shariah-based banks amounted to $6.41 billion, representing 29.68% of the total remittances received that fiscal year.

Bankers said over the past two years, banks have ramped up efforts to increase remittance collections. Expanding networks at foreign exchange houses has boosted remittances.

They, however, said that some banks might have purchased remittance dollars at higher than prevailing market rates, a matter highlighted in the Central Bank’s special inspection report as well.

10 banks see 32% combined growth in remittance

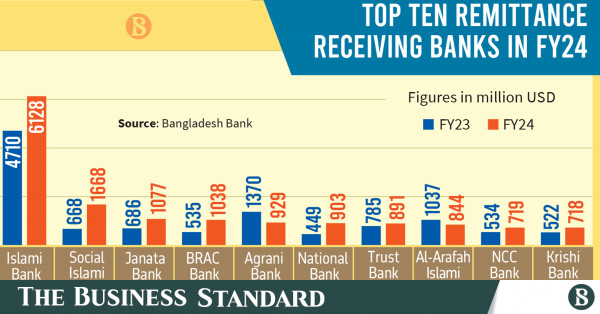

In FY24, remittances through 10 banks totalled $14.91 billion, accounting for 62.35% of the entire banking sector’s total remittance collection.

These banks saw a collective remittance growth of 32% in FY24 compared to the previous fiscal year. In FY23, remittances through these banks amounted to $11.29 billion.

According to central bank data, among these banks, Social Islami Bank showed the highest growth in remittance collection at 150%, followed by National Bank at 101%, BRAC Bank at 94%, Janata Bank at 57%, and Islami Bank at 30%.

Zafar Alam, managing director and CEO of Social Islami Bank Ltd, told TBS that his bank is focused on increasing remittance collections from expatriates primarily located in Saudi Arabia, the Middle East, America, and Europe.

“Last year, I visited several countries, including the US and Singapore, to enhance remittance flows. We have engaged closely with expatriates in these regions, resulting in them opening accounts with our bank and exceeding our remittance targets,” he said.

“We have purchased remittance dollars at the rate set by the central bank, currently capped at Tk118. Previously, we followed the rates fixed by Bafeda. Due to our ample dollar reserves, many importers have chosen to open LCs through us and we continue to support them,” the official added.

According to Md Mezbaul Haque, spokesperson for the central bank, banks have initiated numerous campaigns to boost remittance inflows. Additionally, the scope of investment in the local market and the efforts of law enforcement agencies have contributed to this increase.

Furthermore, the recent adjustments in the dollar rate through the introduction of the crawling peg system have also influenced the growth of remittances, he added.

However, the treasury head of a private bank, on condition of anonymity, told TBS that several banks that previously led in remittance collection have now lagged behind.

“Some banks could not receive sufficient remittances while purchasing dollars at the central bank’s prescribed rate. However, those banks that acquired remittances at rates Tk5 to Tk8 higher than the market rate received more remittances,” he said.

He also mentioned that over the past year, official remittance rates fluctuated around Tk110. However, in reality, some banks acquired remittances at rates exceeding Tk120, with import payments made at rates between Tk122 and Tk124.

According to a central bank official, in 2023, the central bank ordered the removal of treasury heads from six banks due to their involvement in purchasing and selling dollars at inflated prices.

Later, the central bank’s special inspection team discovered instances of overpriced dollar transactions in 10 banks.

However, the central bank’s steps against instances of overpriced dollar transactions contradict a World Bank report. As per the report, the Bangladesh Bank has verbally instructed certain banks to procure dollars at higher rates.

State-owned banks see a decline in remittances

According to central bank data, in FY24, remittances received by state-owned banks decreased by $715 million. In FY23, they collected $3.39 billion, which decreased to $2.68 billion in FY24.

Remittances decreased in five out of six state-owned banks. Only Janata Bank presents a different scenario, with remittances totalling $1.07 billion in this period, marking a 57% increase from the previous financial year.

Top five remittance-sourcing countries

In FY24, expatriates sent the highest remittances from the United Arab Emirates (UAE), amounting to $4.59 billion, followed by $2.96 billion from the US, $2.74 billion from Saudi Arabia, $1.60 billion from Malaysia, and $2.79 billion from the United Kingdom (UK).