Energy, power struggle with $1.75b dues

According to BPC sources, Bangladesh imported 48.80 lakh tonnes of refined fuel oil and 13.14 lakh tonnes of unrefined fuel oil in the fiscal 2023-24

Infograph: TBS

“>

Infograph: TBS

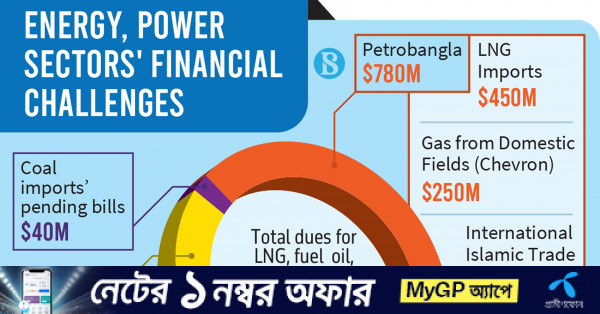

The country’s energy and power sectors are grappling with a significant financial hurdle as dues approach $1.75 billion, mainly from imports of LNG, fuel oil, and electricity, as well as domestic gas extraction.

According to a recent report by the Energy Division, as of 7 July, the Bangladesh Petroleum Corporation (BPC) owes $230 million, while the Bangladesh Oil, Gas and Mineral Corporation (Petrobangla) owes $780 million.

Of Petrobangla’s total dues, $450 million is for LNG imports. Chevron is set to receive $250 million for gas supplied from domestic fields, and the lender International Islamic Trade Finance Corporation (ITFC) will receive $80 million. TBS has obtained a copy of the Energy Division report.

Sources indicate that the BPC and Petrobangla have dues attributed to the dollar crisis. While these organisations have sufficient funds, they struggle to secure necessary foreign currency from the Bangladesh Bank and other banks, which leads to increased debts and penalties.

According to sources at the Power Division, India’s Adani Group is owed $600 million for electricity supply, and there is also a $100 million outstanding bill for electricity from Tripura state of India.

Additionally, the Energy Division reports pending bills for coal imports.

On 7 July, the state minister for power, energy, and mineral resources convened a meeting with ministry officials to address the ongoing issues.

Upon Prime Minister Sheikh Hasina’s return after the China visit, he intends to brief her on these matters. The state minister also plans to take action to secure the needed foreign currency to settle the outstanding dues.

On 8 July, Energy Secretary Md Nurul Alam told TBS over phone, “More gas has been supplied to the power sector this year, and LNG supply has increased due to lower prices in the spot market, which has reduced pressure on fuel oil.

“As a result, the outstanding LNG import bill has increased. This is normal, and we are taking special initiatives to address it.”

Petrobangla Chairman Zanendra Nath Sarker also told TBS on 8 July, “The Bangladesh Bank regularly provides us with foreign currency, and this time, there’s a bit more of accumulated dues. We expect the central bank to expedite dollar supply, which will resolve the issue promptly.”

He added, “There’s no cause for concern. During April, May, and June, gas supply was high due to the summer season, leading to increased cargoes and a rise in outstanding amounts.

“We hope Bangladesh Bank’s timely provision of dollars in July will enable us to gradually clear these dues.”

The central bank was supposed to provide dollars to Sonali Bank for import of essential products such as fuel oil and LNG. However, since mid-May, the Bangladesh Bank has halted dollar supply in this sector.

An official of Sonali Bank, which handles most government imports, said the central bank has not met the demand for dollars, citing the IMF’s reserve requirements. The shortage of dollar supply started to worsen in February and effectively stopped in mid-May, leaving Sonali Bank to face fines from different foreign banks.

Bangladesh is securing a $4.7 billion loan from the IMF, in seven instalments based on meeting specific conditions. These conditions are monitored and reviewed by an IMF delegation that visited Bangladesh in late April.

The IMF delegation scrutinised Bangladesh’s foreign exchange reserves, aiming for a target of $20.19 billion by the end of June. The Bangladesh Bank later informed the IMF it could not achieve that goal, so the IMF adjusted the target to $14.75 billion.

The central bank has since cut back on all foreign exchange spending to meet this new target, despite ongoing demand from government and private banks.

Originally, the Bangladesh Bank was supposed to pay $25 million daily for fuel imports. Instead, it instructed Sonali, Janata, Agrani, and Rupali Banks to collect dollars. But, these banks do not have enough foreign currency to cover the full fuel import bill, causing the outstanding amount to increase.

According to BPC sources, Bangladesh imported 48.80 lakh tonnes of refined fuel oil and 13.14 lakh tonnes of unrefined fuel oil in the fiscal 2023-24.

Petrobangla procured 21 LNG cargoes from the spot market by 3 July this year, along with an additional 21 cargoes from Qatar and Oman under state contracts during the same period.