Urea import uncertain as banks unable to open LCs

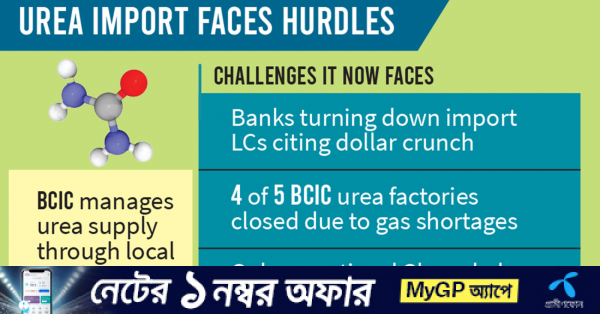

Banks are frequently turning down import LC applications filed by the Bangladesh Chemical Industries Corporation (BCIC), which is responsible for the supply of urea – the primary fertiliser used by farmers

Illustration: TBS

“>

Illustration: TBS

Imports of urea fertiliser have hit a snag as banks face increasing difficulties in securing dollars from the central bank for opening letters of credit (LCs).

Banks are frequently turning down import LC applications filed by the Bangladesh Chemical Industries Corporation (BCIC), which is responsible for the supply of urea – the primary fertiliser used by farmers.

Meanwhile, four out of five urea factories operated by the state-run BCIC were shut down due to gas shortages. The only operational factory, Ghorashal Polash, has an annual capacity of 9.24 lakh tonnes, while the country’s annual demand is 27 lakh tonnes.

With 500,000 tonnes of urea in stock, just enough for the ongoing Aman season, the BCIC is concerned that without increasing reserves now, there will be shortages during the upcoming Boro season in December when rice production peaks.

On 7 July, the corporation wrote to the Prime Minister’s Office, as well as the ministries of industry, finance, and agriculture, highlighting these concerns.

In that letter, BCIC Chairman Md Saidur Rahman said, “Any disruption in the government’s urea import plans will severely affect the fertiliser supply chain leading to detrimental impacts on agricultural production and posing a direct threat to the country’s food security.”

The letter mentioned that the BCIC on 4 July sent a proposal to Sonali Bank to open an LC to import fertiliser from Fertiglobe of the UAE. However, on 7 July, the bank sent back the LC proposal saying it was not possible to open the LC due to the dollar crisis.

“It is critical to start urea imports now. However, banks are refusing to accept our LCs. Sonali Bank has notified us of their inability to proceed,” the BCIC chairman told TBS.

Mentioning that there is sufficient fertiliser stock for the current Aman season, he said, “Our concern lies in ensuring an adequate supply during the peak Boro season. If the government can provide gas to the closed factories as an interim solution, we can ease the crisis.”

Earlier on 16 April, the BCIC submitted a proposal to Agrani Bank to open an LC for importing urea from Karnaphuli Fertiliser Company Limited (Kafco). However, the bank promptly returned the proposal without opening the LC.

Kafco, a multinational joint venture based in Chattogram, requires the government to open an LC as per their contract for urea purchase.

Subsequently, the BCIC forwarded the proposal to Krishi Bank on 21 April, which took 53 days to process the request.

Later, on 29 May, BCIC submitted another LC proposal to Agrani Bank for a subsequent batch of fertiliser imports from Kafco. Agrani Bank processed and established the LC after 32 days.

What the banks say

Attempts to reach the managing director of Sonali Bank via mobile phone multiple times were unsuccessful.

However, in the letter the bank sent to the BCIC rejecting the LC proposal on 7 July, Deputy General Manager of Sonali Bank Mohammed Shahedul Islam said, “Due to the ongoing dollar crisis and instructions from the bank’s head office, we regret that we cannot proceed with the requested LC.”

When called, Agrani Bank’s managing director did not respond. However, his personal secretary, Farid, told this correspondent that the managing director would not make any comment on the matter.

However, Agrani Bank Chairman Zaid Bakht told TBS, “Previously, the Bangladesh Bank used to assist by providing dollars from reserves for government imports. Unfortunately, the central bank is currently not providing any dollars, making it impossible for us to open the LC.”

When asked, Bangladesh Bank Acting Spokesperson Saiful Islam told TBS that banks open LCs based on their relationship with customers.

“If banks do not have enough dollars, they cannot open LCs. BCIC is a government institution and it is dealing with government banks. The Bangladesh Bank’s stance is that decisions will be made based on the bank-customer relationship,” he added.

‘With all factories operating, total demand could be met locally’

According to the BCIC, if the government could ensure gas supply to operate all five urea factories, it could meet the total annual demand of 27 lakh tonnes of fertiliser through local production without any imports.

The BCIC assesses annual urea fertiliser needs and meets demand through domestic production and imports. It also imports and supplies fertilisers through government-to-government contracts.

It does not pay cash to banks for government imports, instead, it uses post-import finance (PIF) loans, secured by a government counter-guarantee.

LCs for fertiliser imports are restricted to four government banks: Sonali, Janata, Agrani, and Bangladesh Krishi Bank, under the Finance Division-issued counter guarantees.

According to BCIC officials, for FY25, the import target for urea is set at 14.5 lakh tonnes under government-to-government agreements. This includes 9 lakh tonnes from Kafco and 5.5 lakh tonnes from other sources.