Govt seeks loan outside dollar to avoid high interest

In response to high interest rates, the government has decided to secure loans in currencies other than the US dollar from the Asian Infrastructure Investment Bank (AIIB), which has agreed to this proposal.

Similarly, the New Development Bank (NDB) now offers the opportunity to take loans in three other currencies besides the US dollar.

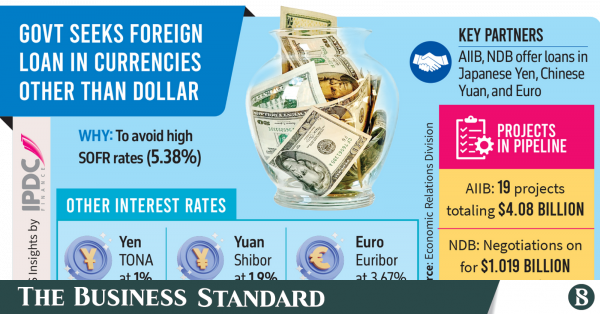

This move will allow the government to take loans in Japanese Yen, Chinese Yuan, or Euro to avoid the high interest rates associated with the Secured Overnight Financing Rate (SOFR) in the US dollar, as reported by the Economic Relations Division (ERD).

According to ERD information, there are currently 19 projects in the AIIB’s pipeline list, with a total loan proposal of $4.08 billion. Additionally, negotiations are underway with the NDB for loans of $1.019 billion for three projects.

Due to the surge in global SOFR interest rates triggered by the Russia-Ukraine war, the government has refrained from taking project loans from the AIIB for two fiscal years due to high interest rates. Instead, it has opted for budget support loans, including one in Japanese Yen obtained last June.

The government has also been slow in utilising NDB loans due to similar high interest rates, despite opportunities. Although Bangladesh joined the NDB in 2021, it has yet to secure any loans from this development partner.

Given the high SOFR rate, currently around 5.38% and potentially reaching 7-8% with additional fees, Bangladesh is exploring alternatives to US dollar loans. The government is particularly interested in Japanese Yen loans due to the Yen’s lower value against the dollar. Additionally, opportunities exist for loans in Chinese Yuan or Euro as alternatives.

If a loan is taken in Yen, interest is paid at the Tokyo Overnight Average Rate (TONA) rate, which is currently 1%. Including other fees, the interest rate remains within 1.5%. The rate for the Chinese Yuan will be based on the China Three Month Interbank Rate (Shibor), and the Euro Interbank Offer Rate (Euribor) will be used for the Euro.

However, due to the higher Shibor and Euribor rates compared to TONA, the ERD is prioritising taking loans in Japanese Yen. Additionally, the fluctuation rate of the Yen against the dollar is lower. Currently, the Shibor rate is 1.9% and the Euribor rate is 3.67%.

ERD officials noted that currency-switching debt servicing is a globally accepted strategy to manage high-interest rate debt. It is better to take loans in alternative currencies, even if there is no reserve crisis, as this defers the high interest rate on loans. Bangladesh has recently decided to adopt this strategy.

In June, Bangladesh secured a $300 million budget support loan from the World Bank in Japanese Yen. Additionally, a Scale-Up Window (SUW) project is being funded with an equivalent of $400 million in Yen.

The World Bank’s board meeting on 22 June approved a $650 million loan for the Bay Container Terminal construction project, with $400 million equivalent to be financed in Japanese Yen.

Loans for World Bank SUW projects are based on market rates or the SOFR. On 27 June, Bangladesh received $400 million equivalent in Yen from the AIIB, which was subsequently converted back into dollars.

ERD officials said that the government negotiated for AIIB’s budget support received on 27 June to be in Yen instead of dollars. Consequently, the government received an equivalent of $390 million in Yen, released by the development organisation on the same day.

Despite receiving $10 million less in this transaction, it has proven beneficial for Bangladesh in the long run. If the loan had been in dollars, the interest rate would have been around 7%, including SOFR and other fees.

However, by borrowing in Japanese Yen, the total interest rate is 1.3%. Moreover, repayment in Yen reduces the risk of dollar appreciation against Yen, placing Bangladesh in a favourable financial position.

List of projects

The AIIB is currently in discussions for significant projects including the Modernisation and Capacity Enhancement of BREB Network in Rajshahi-Rangpur ($350 million), Chattogram-Sylhet ($531 million), Madunaghat 765 KV Transmission Line ($460 million), Integrated Water Supply and Sanitation ($315 million), Dhaka Urban Regeneration ($200 million), and Gas Sector Efficiency Improvement ($280 million).

Meanwhile, the NDB is set to finance three projects—$443 million for repairing and replacing old gas pipelines in Dhaka and Narayanganj, $320 million for the Expanded Dhaka City Water Supply Resilient Project, and $253 million for the Natural Gas Network Capacity and Supply Efficiency Improvement Project of Titas Gas.