How Adani power deal makes electricity costlier

The costly power from Adani’s 1,600MW coal power plant in India is one of the many reasons why Bangladeshis are paying significantly higher rates to use electricity in recent years

Infograph: TBS

“>

Infograph: TBS

With Bangladesh buying some of its power from India’s electricity exchange market at almost half the price of Adani coal power plant, the power deal with the Indian power giant has come into question that had a significant role in increasing Bangladesh’s power price by as much as 8%.

The costly power from Adani’s 1,600MW coal power plant in India is one of the many reasons why Bangladeshis are paying significantly higher rates to use electricity in recent years.

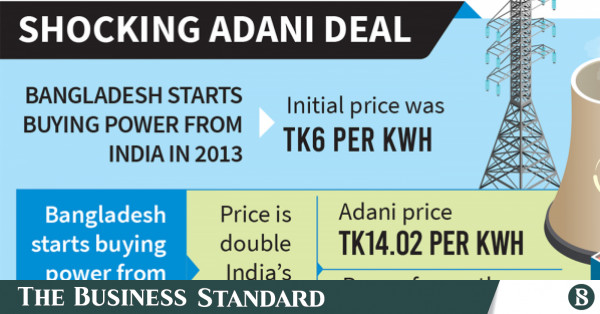

According to official data, Bangladesh bought Adani’s power for Tk14.02 per kilowatt-hour (or a unit) in 2023. Bangladesh bought another 1,100MW power from India’s electricity exchange market at Tk7.83 per unit.

Unfavourable power contracts hiked up tariff

Adani’s alone supplies around one-tenth of Bangladesh’s total power need. And its impact can be seen in the average power generation cost in the country. Whereas average generation cost was Tk5.91 per unit five years back, and Tk8.84 in 2021-22, it has become Tk11.03 per unit now. However, Adani’s power is not the only factor in such an increase. There are several other unfavourable power contracts that have contributed to this situation.

After Adani started selling the costly power to Bangladesh, electricity became the top item in its Bangladesh export basket. India’s power export bill shot up to $1 billion plus and Adani pocketed most of it.

Before Adani in the picture, power import from India was favourable for Bangladesh. The country’s electricity import from India started in 2013 under a framework agreement signed in 2010. Till the dollar rate started to shoot up, the cost of India’s power was around Tk6 per unit.

Bangladesh has been buying 1,600MW power from Adani’s plant since 2023 under a deal signed in 2017 without any public disclosure. The Adani plant was totally dedicated to supplying power to Bangladesh until the fall of Sheikh Hasina earlier this month. Then within no time, the Indian government permitted Adani plant to sell power in the Indian market as well.

Adani Power supplies 1,600MW at a cost of Tk14 per unit, adding to the total generation of 14,000MW, which costs Tk8 per unit on average.

This raises the average unit cost by 7.69% to Tk8.61 per unit, solely due to the uneven import deal with Adani Power.

The decision to buy Adani’s power also surprised everyone in the energy industry – because Bangladesh now has huge surplus power generation capacity. Right now, power plants having as much as 10,000MW capacity are sitting idle – mostly for lack of primary fuel.

With average power generation cost of Rs6.29 per unit, India has many sources from where Bangladesh could have purchased cheaper power.

Mounting unpaid bills add to woes

As Bangladesh’s dollar crisis lingers, officials are now worried about mounting unpaid bills for imported electricity. Adani’s power alone is adding $100 million every month to the bill.

Power officials feel the Adani power deal must be reviewed to relieve the exchequer from the huge cost burden. They say Adani’s electricity tariff is much higher compared to similar sources. If the deal can be reviewed, the Adani power cost could be halved, according to a UNB report that quoted officials of Bangladesh Power Development Board (BPDB).

Opaque deal

Even before commercial supply began in April last year, power officials had raised concerns over the Adani plant’s coal pricing formula and requested a revision of the power purchase agreement.

In a letter to Adani Power in December 2022, the Power Division mentioned that Adani quoted $400 per tonne of coal, which was $245 per tonne for Payra power plant in Bangladesh.

But their concerns were not considered.

“What is agreed will remain as it is. Electricity prices will increase and decrease, along with coal’s price on global markets,” the then state minister for energy Nasrul Hamid told the media in February 2023.

The rationale of the power purchase agreement (PPA) with Adani was questioned soon after it was signed in Dhaka in November 2017, when the country already had higher installed capacity than actual generation. By the time Adani power started flowing into Bangladesh, the installed capacity rose to 24,911MW in June 2023, with peak generation reaching 15,648MW in that fiscal year.

Experts also found the then government’s projection of future generation electricity was based on an unrealistic estimate of demand growth. The Centre for Policy Dialogue (CPD) found the government’s projection – energy demand to cross 50,000MW in 2041 – “overly ambitious” and based on unrealistic demand growth in the integrated master plan drafted by the energy ministry in June 2022.

Already, there were a number of coal-based power plants either under construction or planned. With Bangladesh’s gas reserves dwindling, the government was opting for coal-based and fuel oil-run private power plants, leading to higher generation cost and increased spending in subsidy and capacity charge.

By the time electricity supply started from Adani’s first unit in April last year, the government was being increasingly burdened with unpaid bills of local power and gas producers due to both cash crunch and dollar crisis. The crisis worsened with the time and the BPDB’s arrears reached to around Tk33,109 crore to power producers as of April this year. Of the amount Tk5,297 crore is owed to Indian import sources including Adani.

On 29 May, India’s Adani Group Director Pranav Adani met the then finance minister Abul Hassan Mahmood Ali requesting quick clearance of outstanding electricity bills amounting to around $700 million.

Adani’s high-profile links

After the fall of the Sheikh Hasina regime on 5 August, the Adani power deal re-emerged in talks.

Within a week, India’s ministry of power on 12 August cleared the way for India’s export-only power plants to sell electricity in the domestic market in case of default in payments from the export market.

Currently being the sole export-only power plant in India, Adani stands out to be the key beneficiary of the change in India’s energy export rules.

However, Adani said the change would not affect its supply to Bangladesh.

“Adani continues to supply electricity to Bangladesh as per demand. Adani Power supplied above 750MW to Bangladesh yesterday and 769MW today as per the country’s demand,” it said on 14 August.

Adani founder Gautam Adani stunned the corporate world with a steep rise to fame in the last decade, briefly ousting Jeff Bezos as the second richest in the world.

The Washington Post in a report in December 2022 said the self-made billionaire’s ascent was “closely tied to the rise” of Indian Prime Minister Narendra Modi, who “laid the groundwork” for the Godda plant during his visit to Bangladesh in 2015.

The deal was signed two years after Modi’s Dhaka visit. The plant’s first unit started commercial operation in April and second unit in June last year. Gautam Adani was in Dhaka in July last year to officially hand over the power plant. “Honoured to have met Bangladesh PM Sheikh Hasina on full load commencement and handover of the 1,600MW Ultra Super Critical Godda Power Plant,” he posted on X handle along with photos with the then prime minister.

Call for review

Energy expert Prof M Tamim says the Adani power deal requires scrutiny. “I don’t know what is inside the agreement. If there is any serious lack of fairness and equity, it definitely calls for a review.”

It is not acceptable if the deal appears to be one-sided and electricity tariff is found higher than that from similar plants such as Payra, Matarbari or Rampal, he said.

Usually, such purchase agreements contain clause that allows renegotiation in case of any disputes or withdrawal by any of the parties in case of any violation of the contract, said Prof Tamim, a teacher of Petroleum and Mineral Resources Engineering, Buet, who was a special assistant to the 2007-08 caretaker government chief on energy affairs.

“It depends on the type of the contract. All such deals are expected to be balanced, protecting the investors as well as being win-win for all parties,” he said.

M Shamsul Alam, vice president of the Consumers Association of Bangladesh, said the deal must be reviewed as it was unsolicited and favoured only the investor undermining the national interest.

“Even it can be scrapped altogether. If the government does not do it, people can go to court seeking to scrap the Adani power deal,” he said, citing instances of such legal steps against Niko and some others.

As there was no bidding, the investor maximised their gains and got the deal signed absolutely in their favour, the energy analyst said. When procurement costs rise, the single buyer, the state-owned PDB, passes it on to consumers and makes them pay a high price for electricity. “Here the government itself appears to be profit-monger,” he pointed out.

The Quick Enhancement of Electricity and Energy Supply (Special Provision) Act, 2010 allows signing deals without tender for all types of power and energy projects, including electricity generation and transmission, gas exploration or import of coal and other fuels. In 2021, the law got a five-year extension to 2026.