Stocks extend bearish trend for 2nd week

DSEX sheds 204 points last week

Infographic: TBS

“>

Infographic: TBS

Dhaka Stock Exchange indices fell for four consecutive sessions last week due to investor concerns over ongoing capital market reforms and economic uncertainty.

The bearish trend has now extended for two consecutive weeks, with investors selling off their stakes and mostly waiting for a better opportunity to re-enter the market.

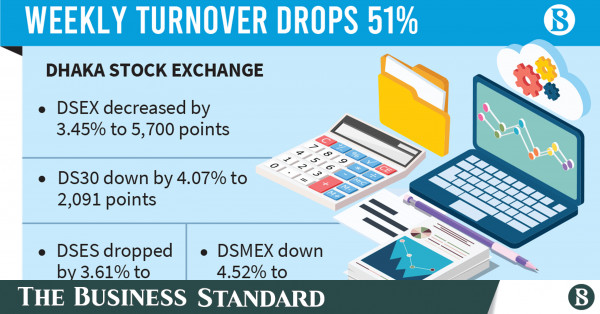

At the end of last week, the prime index, DSEX, decreased by 204 points or 3.45% to 5,700 points. Meanwhile, the blue-chip index, DS30, dropped by 4.07% to 2,091 points, while the shariah-compliant index, DSES, declined by 3.61% to 1,219 points. At the same time, DSMEX (DSE SME Index) dropped by 4.52% to 1,233 points.

The weekly average turnover dropped by 51.30% to Tk624.41 crore compared to the previous week. The total turnover stood at Tk3,122 crore, down from Tk6,411 crore a week ago.

The market capitalization dropped by 2.28% to Tk6,92,831 crore from Tk7,08,964 crore compared to the previous week. Of the total scrips traded, 32 advanced, 357 declined, 5 remained unchanged, and 19 were not traded.

The share price of Midland Bank rose by 12.09% to Tk24.10 on the DSE, capturing the weekly top gainers’ list, followed by NBL 9.33% to Tk8.20, Olympic 8.31% to Tk178.60, Islami Bank 7.77% and Dulamia Cotton 6%.

On the other hand, SEML FBLSL Growth Fund was down by 14.52% to Tk5.30 on the Dhaka bourse to top the losers’ list, followed by Orion Infusion 14.05% and Heidelberg Materials Bangladesh 14.03%.

The share price of Grameenphone rose by 9.24% to Tk346.20 on the DSE to top the turnover list, followed by BRAC Bank with 7.05% to Tk53.20, Square Pharmaceuticals with 4.53% to Tk230.30, UCB with 3.37%, City Bank with 3.15% and BATBC with 3.01% gain.

EBL Securities in its weekly market commentary said that the capital bourse benchmark index extended its losing streak for two consecutive weeks as investors preferred to remain watchful amid ongoing reforms within the regulatory body of the capital market, along with the board reformation of particular banking companies.

The market mostly remained sell-dominant throughout the week as cautious investors opted to trim their exposure to capital market investments due to dwindling confidence, dragging down the benchmark index further to concede the week in losing territory despite bargain hunters’ efforts to rescue the market in the final session by taking positions in certain lucrative scrips following major corrections, according to the commentary.

Investors were mostly active in the bank sector holding 27.3% of transactions, followed by the pharmaceutical industry with 15.1% and telecommunication sector with 11.6%. Paper sector became the biggest loser with 9.6% down.

The port city bourse, CSE, also settled on red terrain. The turnover of the bourse stood at Tk51.80 crore.

In the last week, the volume of shares was 1.81 crore. Of the total scrips traded, 28 advanced, 260 declined, and 12 remained unchanged out of 300.

The selected indices (CSCX) and All Share Price Index (CASPI) declined by 3.84% and 3.83%, respectively.