How UCB loans were given to ineligible firms

An investigation by TBS into UCB’s loan records reveals a troubling pattern of financial mismanagement. Among the documents reviewed, another particularly glaring example stands out: UCB’s Karwan Bazar branch granted a staggering Tk400 crore loan to AWR Developments (BD) Limited

Infographic: TBS

“>

Infographic: TBS

At Aramit Limited, protocol officer Mohammad Forman Ullah, who earns Tk20,000 a month, was stunned to learn he was linked to a Tk25 crore loan from United Commercial Bank (UCB), controlled by the same influential family as his employer.

Forman, who has no other business, was shocked by the revelation that the loan was granted to Vision Trading, a company he is listed as owner on paper.

The loan, meant for 180 days, has remained unpaid for over 1,200 days.

The likelihood of repayment seems increasingly remote, a senior official at UCB’s head office told TBS. The official, who spoke on condition of anonymity, expressed deep concern about the way the bank had been managed under Saifuzzaman and his family during the Awami League’s tenure in government.

“They’ve extended loans to weak firms, some of which exist only on paper,” the official noted.

An investigation by TBS into UCB’s loan records reveals a troubling pattern of financial mismanagement. Among the documents reviewed, another particularly glaring example stands out: UCB’s Karwan Bazar branch granted a staggering Tk400 crore loan to AWR Developments (BD) Limited.

The loan was meant to fund a river dredging project valued at Tk600 crore. However, AWR Developments’ work order was eventually cancelled due to significant deficiencies, including a lack of experience and proper equipment.

In standard banking practice, loans against work orders are disbursed in phases, aligned with project milestones. But in this case, UCB bypassed these safeguards, releasing 70% of the loan amount upfront – a decision that now raises serious questions about the bank’s lending practices.

Several officials of the bank hinted at the influential and family connections.

AWR Developments is owned by Mohammed Adnan Imam, who is also the chairman of NRBC Bank’s executive committee. Adnan’s alleged friend, Anisuzzaman Chowdhury, chairman of UCB’s Executive Committee, facilitated the approval of the loan for AWR, officials said.

Anisuzzaman is the younger brother of former land minister Saifuzzaman, whose wife, Rukhmila Zaman Chowdhury, served as UCB’s chairman.

Meeting minutes of the UCB board show AWR Developments was granted a total of 31 loans, with the current outstanding amount reaching Tk757 crore. Despite several years of non-recovery, the bank has repeatedly extended the loan repayment period.

Anisuzzaman told TBS that AWR Developments is a reputable company and that the loan was issued in compliance with Bangladesh Bank’s rules and regulations.

He said the company’s directors provided personal guarantees, and there were additional company guarantees and mortgages.

However, Anisuzzaman did not address the issue of AWR’s work order cancellation or why he did not repay the loans.

Despite multiple attempts to contact Acting Managing Director Abul Alom Ferdous by phone and message, he has not responded.

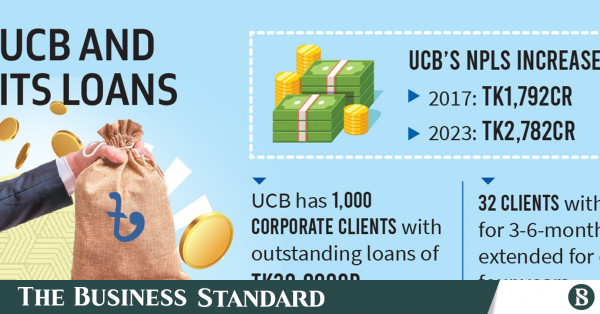

According to central bank data, UCB’s non-performing loans increased from Tk1,792 crore in 2017 to Tk2,782 crore by December 2023.

A central bank inspector said the actual amount of bad loans might be even higher, as many weak firms have not repaid their debts but continue to receive loan extensions from the bank’s board.

Corporate loans

A June 2024 report reveals that UCB’s corporate division has nearly 1,000 clients with outstanding loans totaling around Tk30,000 crore, including interest.

Among them, 32 clients in post-import financing have loans amounting to Tk670 crore, typically with terms of three to six months.

Despite this, many loans have been extended for over four years. Without these extensions, these clients would have been classified as defaulters long ago.

Additionally, 118 customers with Tk2,353 crore in loans have had their facilities extended, 42with Tk2,322 crore in time loans have had deadlines deferred, 89 with Tk1,077 crore in outstanding loans have had deferral periods extended, and 154 with Tk13,577 crore in composite facilities have also had their validity extended.

Tajmilur Rahman, former head of the Corporate Division, said they only processed loan proposals, but final approval came from the board.

He added that their role was limited to processing proposals based on available information, with no authority to approve loans.

Regarding repeated loan extensions, a senior UCB official said it was due to the economic downturn caused by the Covid-19 pandemic and the Ukraine-Russia conflict.

“However, some loans have been granted to clients for whom recovery is virtually impossible, regardless of how long the repayment period is extended,” the official acknowledged.

Two loans leave Banani branch struggling

UCB’s Banani branch is struggling with two loans, also involving Adnan Imam, vice chairman of NRBC Bank, and allegations of collusion with the family of former land minister Saifuzzaman.

One loan, for Azan Trading International, amounts to Tk600 crore, while another for TSN Trade & Infrastructure Development totals Tk260 crore.

UCB’s board minutes reveal that Azan Trading has 31 loan accounts, all of which have had their repayment periods extended by the board. TSN Trade & Infrastructure has five similar accounts.

Documents show the collateral for these loans is worth less than Tk10 crore, with properties listed in Chattogram but collateral shown as land in Dhaka’s Bashundhara area.

Branch officials said the chances of recovering the Tk860 crore loan from these two companies are very low.

Inflated companies

At UCB’s Pragati Sarani branch, SS Steel Limited secured a Tk50 crore loan after a year, but soon sought an additional Tk300 crore. Despite an inspection showing it was only eligible for Tk10 crore, the head office approved Tk250 crore.

Branch officials alleged fraudulent documentation and links to Salman F Rahman, though his involvement is unconfirmed.

SS Steel, also a National Bank client, took Tk700 crore from them without repayment. The factory it acquired was valued at Tk25 crore during a recent assessment, despite an earlier valuation of over Tk100 crore.

At UCB’s Kawran Bazar branch, Bangla UK Agro Limited received Tk350 crore in loans, although its eligibility was only Tk50 crore. Similarly, Fulpur Agro received Tk20 crore in loans despite being eligible for just Tk5 crore.

Big loans to paper-only and ineligible firms

Officials at UCB’s Karwan Bazar branch said large loans were disbursed to paper-only companies such as Techsol Engineering, AH Enterprise, Juventus International, ITS Juventus, Group Six, G Six International, Bangla Farm House, Khondkar International, and Alok International.

They claimed the board exerted constant pressure to approve these loans, with minimal on-site verification.

Additionally, allegations have been made against UCB’s Khatunganj branch in Chattogram for issuing loans to fictitious entities like Asia International (Tk80 crore), Eminent Traders (Tk20 crore), Absar & Sons (Tk20 crore), and Fortune Enterprise (Tk11 crore).

Loans obtained through fraudulent documentation for small trading firms have been alleged by officials.

TBS has a list of such companies, including Auto Trans (Tk16.5 crore), Crystal Enterprise (Tk20 crore), Excellent Textile (Tk8 crore), Progressive Trading (Tk4 crore), RN International (Tk9 crore), Rose Trading (Tk11 crore), and Rudd Creation (Tk6 crore).

The Chattogram Port branch is also implicated with loans to Vision Trading (Tk30 crore), GHM Traders (Tk6 crore), BH Corporation (Tk7.44 crore), Reliable Trading (Tk21.56 crore), Tashin Poultry (Tk13.13 crore), Cats Eye Corporation (Tk8.25 crore), and Zakir Traders (Tk11.34 crore).

These borrowers have been receiving deferment benefits without repaying their loans, according to the bank’s board memos.

Wife out, sister in

UCB was founded by late Awami League leader Akhtaruzzaman Chowdhury Babu, with Partex Group’s founder MA Hashem also playing a key role.

Until 2016, members of the two families led the bank. In 2017, the Partex family was allegedly forced to leave, and Rukhmila, Saifuzzaman’s wife, became the chairperson.

However, UCB officials claim that Saifuzzaman effectively managed the bank.

A recent letter to Bangladesh Bank from some shareholders alleges that although Rukhmila was the chairperson, Saifuzzaman ran the bank and had driven it toward insolvency through “arbitrary actions and embezzlement”.

The letter, which TBS obtained, also claims Saifuzzaman holds assets worth Tk1,888 crore in the UK, allegedly funded by misappropriated bank deposits.

Meanwhile, Roxana Zaman Chaudhury this month was appointed as the new chairperson of UCB, succeeding Rukhmila.

The new chairperson, Roxana, is Saifuzzaman’s sister.

The leadership change comes amidst directives from the financial intelligence agency, BFIU, to freeze the bank accounts of Saifuzzaman and Rukhmila.