Stocks plunge on selling pressure, but turnover jumps

Infographic: TBS

“>

Infographic: TBS

Stocks ended today’s session lower due to selling pressure, but both Dhaka and Chattogram bourses witnessed a significant jump in turnover value, indicating that many investors liquidated their holdings because of the uncertain market outlook.

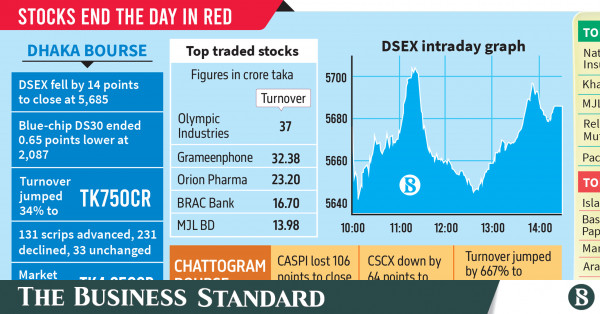

On the day, DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), plunged by 14 points to close at 5,685, while the blue-chip index DS30 inched down by 0.65 points to settle at 2,087.

Besides, the port city bourse Chittagong Stock Exchange’s (CSE) all-share price index CASPI dropped by 106 points to close at 16,268, while the general index CSCX ended 64 points down at 9,800.

EBL Securities in its daily market review said the equity indices of the Dhaka bourse failed to remain afloat in green territory despite investors being active on both sides of the trading fence as sellers ended up on the dominant side as they remained clung to an uncertain market outlook amidst a weakened market momentum.

Investors remained watchful of the market’s trend and preferred to trim their holdings in particular volatile scrips, causing the broad index to close in negative territory again, it added.

Meanwhile, the DSE turnover, a crucial market indicator, witnessed a 34% increase to reach Tk750 crore, while the Chattogram bourse saw a 667% rise to Tk223 crore.

On the sectoral front on the DSE, the food sector contributed the highest turnover, accounting for 21.9% of the total, followed by the pharma and the banking sectors.

Olympic Industries topped the DSE turnover list with a value of Tk37 crore, followed by Grameenphone, Orion Pharma, BRAC Bank, and MJL Bangladesh.

The CSE turnover was mainly driven by BAT Bangladesh and Meghna Petroleum, with both stocks being traded amounting to Tk101.56 crore and Tk101.24 crore, respectively.

The DSE also saw significant trading in the block market, with a turnover value of Tk215 crore. The top-traded stock was BAT Bangladesh, with a turnover of Tk100 crore, followed by Renata and Jamuna Oil.

Meanwhile, sectors displayed mixed returns, out of which paper, telecom and non-bank financial institutions exerted the most corrections on the DSE, while life insurance, textile, and fuel and power exhibited slight positive returns.

National Life Insurance topped the gainers’ list as its share price jumped by 9.95% to reach at Tk125.9, followed by Khan Brothers PP Woven, MJL Bangladesh and Reliance One Mutual Fund.

Islami Bank Bangladesh performed the worst on the day, with its share price dropping around 4%, followed by Bashundhara Paper, Marico and Aramit Cement.