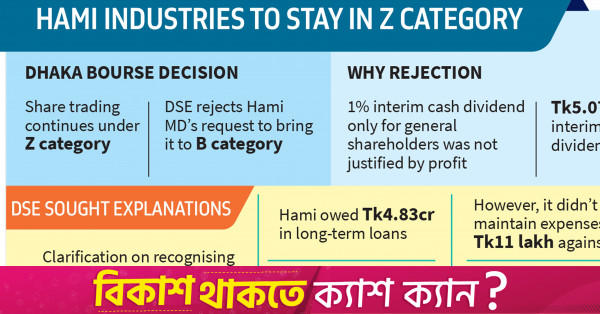

Why DSE rejected Hami Industries’ plea for category change

In early August, ASM Hasib Hasan, managing director of Hami Industries, wrote to DSE, requesting a reclassification from the Z to the B category

Infographics: TBS

“>

Infographics: TBS

The Dhaka Stock Exchange (DSE) has decided that the shares of Hami Industries, formerly known as Imam Button Industries, will stay in the Z category as its profits cited in the plea for reclassification were deemed “inflated”.

In early August, ASM Hasib Hasan, managing director of Hami Industries, wrote to DSE, requesting a reclassification from the Z to the B category.

However, since the fall of the Sheikh Hasina-led government, Hami’s share price has been consistently declining. On 6 August, its shares were priced at Tk149.2 each, but by Wednesday (28 August), they had dropped to Tk112.7 each.

Hami Industries paid a 1% interim cash dividend only for the general shareholders for the period of 31 March this year.

In a disclosure published yesterday, the DSE said, “The interim dividend declared by Hami Industries does not appear to be justified by the profits on the basis of third quarter reviewed financial statements, which falls under non-compliance of a directive of the Bangladesh Securities and Exchange Commission (BSEC).”

“Therefore, for the above non-compliance, Hami Industries shall not be considered for an adjustment or placement of categorisation from the existing Z category based on declared dividend,” the disclosures read.

Hami Industries, which was formerly known as Imam Button Industries, was incorporated in 1994 and is a subsidiary of the Chattogram-based Imam Group.

Imam Button, which had been inactive since the 2018-19 financial year, restructured its board in January 2023 under the BSEC oversight. ASM Hasib Hasan became managing director after acquiring more than 2% of the shares.

In August last year, Imam Button, a producer of buttons for ready garment industries, resumed its operation as it expanded its footprint in agro-projects. In December 2023, it entered into a tannery business on its factory premises in Chattogram.

In March this year, in a physical inspection, the DSE found that Imam Button’s ponds had been found without any fish, and its shoe factory was not capable of making more than 20 pairs a day.

The company failed to provide any documentation for its fish business, and the disclosure provided by the tannery unit at the start of business is “misleading and fabricated,” the inspection report reads.

In a letter to the Chief Regulatory Officer (CRO) of the DSE on 6 August, ASM Hasib said, “We are pleased to inform you that we have declared and disbursed a 2% interim cash dividend in the best interest of our shareholders.”

Subsequently, the DSE requested further clarification from Hami Industries regarding the quarterly statements ending on 31 March.

The DSE noted that the company recorded loans of Tk4.83 crore—Tk4.37 crore as long-term and Tk45.82 lakh as short-term at Prime Finance Investment. However, Hami Industries did not account for financial expenses of Tk11.03 lakh related to these loans in its profit and loss statement.

The DSE has asked Managing Director ASM Hasib to explain why these financial expenses were not included in the statements.

According to Hami’s third-quarter statements, the long-term loan of Tk4.37 crore was taken by the previous management of the company from Prime Finance and Investment. “We were not aware of the loan as a new management,” they said.

“The financial institution [Prime Finance Investment] suddenly claimed the money from us. Moreover, there is pending litigation by Prime Finance in the court against the previous management of the company and there was no information regarding this loan till June 2018,” the company said.

“So, the board of directors have decided the loan amount should be accounted for in the name of the former managing director,” it said.

The DSE also requested detailed information and documentation regarding the utilisation of a share money deposit amounting to Tk5.38 crore. Additionally, the DSE sought clarification on the company’s turnover, cash received from customers, and trade receivables.

According to the DSE’s letter to Hami Industries, the company reported a turnover of Tk2.25 crore, cash received from customers of Tk1.57 crore, and trade receivables of Tk68.22 lakh as of March.

The DSE instructed the company to provide clarification by 18 August.

A DSE official told TBS, “The explanation and documents provided by the company were not satisfactory. As a result, the management has decided to keep the shares in the Z category, and trading will continue under this classification.”