Ctg port’s Tk1,144cr FDRs stuck in 6 banks tied to S Alam, Nafeez Sharafat

Despite the CPA’s urgency, the banks could not provide a concrete timeline for repayment.

Infograph: TBS

“>

Infograph: TBS

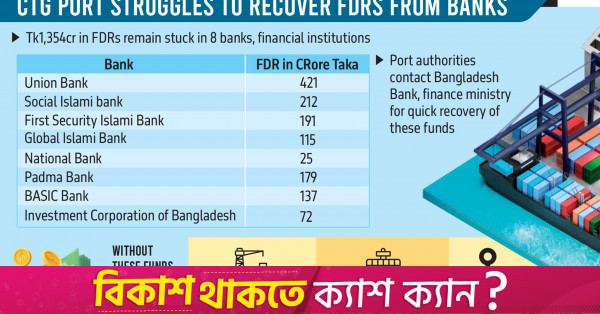

The Chittagong Port Authority is in a quandary over reclaiming Tk1,354 crore in fixed deposit receipts (FDRs) from eight banks and financial institutions hit by loan scams.

Of this amount, a significant portion – Tk1,144 crore – is invested in six banks linked to the controversial S Alam Group and a businessman named Chowdhury Nafeez Sharafat.

According to a letter from the CPA to the Bangladesh Bank on 29 August, five banks with ties to the S Alam Group hold Tk965 crore in FDRs, while Padma Bank, associated with Nafeez Sharafat, has Tk179 crore.

Before the recent changes to banks’ boards by the central bank, the S Alam Group had representatives on the boards of these five banks – Union Bank, Social Islami Bank, First Security Islami Bank, Global Islami Bank and National Bank.

Nafeez Sharafat formerly served as the chairman of Padma Bank but stepped down early this year amid allegations of financial misconduct.

Currently, S Alam and Nafeez only hold stakes in these banks.

Documents reviewed by TBS reveal that several months ago, the CPA requested the banks to encash the FDRs and deposit the funds into its account by 22 July. However, the banks did not comply with this request.

On 27 August, following repeated non-compliance by the banks, CPA Chairman Rear Admiral SM Moniruzzaman convened a meeting with officials of the banks concerned to recover the deposited funds.

Despite the CPA’s urgency, the banks could not provide a concrete timeline for repayment. Some suggested gradual returns starting this November or in January next year but failed to provide the commitments in writing, even when pressed.

The CPA chairman emphasised that the lack of funds would hinder the progress of key development projects, including Matarbari port, heavy lift jetty, and bay terminal.

He also warned sternly that any bank failing to return the FDR funds would face legal consequences, according to meeting minutes.

In addition to the CPA’s own funds, the pension and provident funds for their officers and employees are also deposited in these banks.

CPA Secretary Md Omar Faruk told TBS, “The Chittagong Port Authority has approximately Tk900 crore in fixed deposits with four banks, including Union Bank, First Security Islami Bank, and Social Islami Bank.

“We have requested these banks to return the funds and have held meetings with them on this issue. The banks have asked for additional time to repay the money. We have also notified the Bangladesh Bank on this.”

The CPA has contacted both the secretary of the Financial Institutions Division and Bangladesh Bank Governor Ahsan H Mansur, seeking to recover the total of Tk1,354 crore in FDRs.

CPA Chairman SM Moniruzzaman in a 29 August letter said keeping the FDRs in these banks is becoming increasingly risky.

According to the letter, the CPA holds FDRs worth Tk421 crore in Union Bank, Tk212 crore in Social Islami Bank, Tk191.76 crore in First Security Islami Bank, Tk115 crore in Global Islami Bank, and Tk25 crore in National Bank.

In addition, the CPA has Tk137 crore in the state-owned BASIC Bank and Tk72 crore in the Investment Corporation of Bangladesh (ICB), none of which have returned the funds.

The CPA may have faced challenges in taking tougher actions due to S Alam Group Chairman Saiful Alam and Nafeez Sharafat’s close ties with the former government. However, the situation changed after the AL government was overthrown on 5 August.