A close look at S Alam’s Singapore empire

TBS finds S Alam’s investment of at least S$730m in hotel, commercial space, real estate in Singapore

Infographics: TBS

“>

Infographics: TBS

On a sunny August morning, I was standing at the crossroads of Jalan Merlimau and Thomson Road in Singapore. The summer sun beat down mercilessly as I looked for the number plate of the huge three-storey mansion – a penthouse sprawled over 12,000 square feet.

Strangely, I could not find any number plate.

But it must be No 3 Jalan Merlimau; the building right next to it is No 5. I crossed the road to the high-rise – that one is No 2. So there is no question that the mansion opposite is No 3 Jalan Merlimau, which is owned by Bangladeshi oligarch Saiful Alam Masud, commonly known as S Alam, chairman of S Alam Group.

I peeked inside and saw lines of parked Porsches and Jaguars among other costly luxury cars.

I checked the address with Google. The same house I was standing in front of appeared on the screen – 3 Jalan Merlimau. All the houses on Jalan Merlimau have number plates in front of their gates, except No 3.

I hesitated to ring the bell, but just then, the gate opened, and a young girl, who appeared to be a Filipino, and a Bangladeshi woman appeared with trash bags. Just by the gate sat a green and a blue bin.

I approached the women and asked if it was No 3. They curtly said “yes” and went back inside.

S Alam’s 12,260 sq-ft, three-storey mansion on Jalan Merlimau in Singapore, built in 2019, is valued at a minimum of S$30 million. Photo: Jebun Nesa Alo

“>

S Alam’s 12,260 sq-ft, three-storey mansion on Jalan Merlimau in Singapore, built in 2019, is valued at a minimum of S$30 million. Photo: Jebun Nesa Alo

Along came a group of Bangladeshi labourers who were working at a construction site on Thomson Road. I asked them if they knew who lived in the house.

“S Alam of Chattogram,” one of them replied. “His entire family is here. If you wait for a while, you can see them going in and coming out in posh cars.”

Back in my hotel room a few days ago, I was checking on the websites of the Singapore Land Authority (SLA) and the Accounting and Corporate Regulatory Authority (ACRA).

Also, one of S Alam’s close associates was helping me rifle through document after document to identify the owner of the 3 Jalan Merlimau mansion.

S Alam constructed the mansion in 2019 on 12,260 sq-ft, which is worth at least S$30 million (Singapore dollars) at the current market price, equivalent to more than Tk300 crore.

From here, my investigation into the S Alam empire in Singapore started.

Over the next few days, I found an amazing amount of documents that establish S Alam’s investments in real estate and hotels. His investments were also reported in the city state’s different media.

S Alam’s S$700m investment in Singapore

S Alam, who is accused of syphoning off billions of dollars, started to build a business empire in Singapore by setting up different companies in his own and his wife’s names in the last decade since 2009, according to the ACRA.

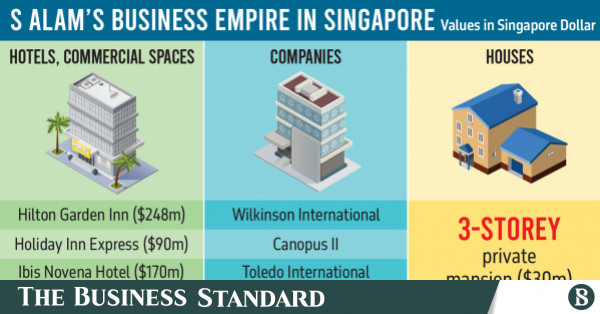

The field investigation conducted in Singapore by The Business Standard found that S Alam invested nearly S$700 million (equivalent to Tk6,300 crore at current dollar price) in acquiring three hotels and retail space in a shopping mall.

Business profile of Grand Imperial Hotel. Photo: TBS

“>

Business profile of Grand Imperial Hotel. Photo: TBS

The acquired properties include three hotels: Grand Imperial Hotel Singapore in Little India, which was rebranded as Hilton Garden Inn for nearly S$248 million; Holiday Inn Express in Serangoon for nearly S$90 million; and Ibis Novena Hotel in Singapore’s Novena area for S$170 million.

Additionally, he acquired retail space of 27,179 sq-ft – all on the first two levels of Centrium Square located in Little India near Mustafa Centre – for S$135 million.

Centrium Square, where S Alam purchased the first two levels totaling 27,179 sq-ft, is an extension of the Mustafa Centre shopping mall located in Little India, Singapore. Photo: Collected

“>

Centrium Square, where S Alam purchased the first two levels totaling 27,179 sq-ft, is an extension of the Mustafa Centre shopping mall located in Little India, Singapore. Photo: Collected

All the purchases were made through four companies, including Canali Logistics (later renamed Wilkinson International), Canopus II, Toledo International, and Grand Imperial Hotel.

S Alam was found connected with these four companies in the investigation by TBS.

All the financial transactions are with United Overseas Bank Limited (UOB) in Singapore, according to ACRA documents.

ACRA, which is a statutory board under the Ministry of Finance of the Singapore government, shows that S Alam, his wife Farzana Parveen, and his office staff are shareholders of these four companies registered in Singapore.

The Business Standard reporter visited all these offices and found evidence of S Alam’s investment, which he made without taking approval from the Bangladesh Bank. He transferred this money through hundi and over-invoicing of LCs (Letters of Credit), mostly against sugar imports, said his office staff.

S Alam Group, which controls the domestic sugar market as one of the largest suppliers, imports sugar mostly from a global merchant firm in Singapore.

Two top bankers from his two banks, Union and Islami banks – whose names we are not using as we could not verify their involvement – were allegedly helping S Alam in laundering money through hundi and over-invoicing.

In all the registered documents of the four companies in Singapore, S Alam and his wife Farzana introduced themselves as Cypriot nationals.

S Alam used two house addresses in the registration documents of the companies. Of the two, the latest house is 3 Jalan Merlimau, a three-storey private house constructed in 2019. ACRA documents show that S Alam transferred this property to the name of Zico Trust, and the transfer was registered in April 2023.

The house is just adjacent to Thomson Road, which is undergoing construction work. Many Bangladeshis work at this construction site.

When talking with this visiting reporter, a worker who went there from Gazipur said he has been working for five years at the construction site. He has seen the construction of S Alam’s 3 Jalan Merlimau house. All Bangladeshi workers know about S Alam and his family, who are staying at the house. S Alam’s three sons and their family members were seen living in this house.

The house is surrounded by CCTV cameras, and the house number was removed. This reporter talked with a Filipino man who lives at 2 Jalan Merlimau, a condominium.

In a casual conversation with this reporter, he said that he saw the residents of this house using very luxurious cars like Jaguars and Porsches. He was surprised to see how rich Bangladeshi people are.

Before this, they used another house address in registration documents, which is a condo located on 2A Lincoln Road, #29-10 Park Infinia At Wee Nam, Singapore.

The average size of these condos is 1,500 sq-ft, and the market price is nearly S$4 million, equivalent to more than Tk30 crore, according to TBS findings.

When asked about the Singapore government’s stance on Bangladeshis accused of money laundering taking shelter in Singapore, Josephine Teo, the county’s minister for Digital Development and Information, said they will not take any action until they are reported to Interpol.

Teo, who is also Singapore’s second minister for Home Affairs, said they can cooperate with the Bangladesh government to take back accused money launderers only if there is an extradition treaty.

TBS called and texted S Alam several times, seeking his comments on the allegations raised against him, but he did not respond.

Canali Logistic

In 2009, S Alam set up Canali Logistics, also known as Wilkinson International, by issuing 3 crore ordinary shares worth S$30 million, equivalent to Tk270 crore at current market prices, as paid-up capital.

S Alam holds 2.10 crore shares, and his wife Farzana holds 9,00,000 shares, according to the ACRA document. The paid-up capital was deposited with UOB Bank in Singapore.

The principal activities of the company are listed as shipping agencies (freight), shipping and logistics, and hotel investment.

S Alam and Farzana are directors of the company as Cypriot citizens, and Thajudeen Nasirudeen, an Indian national, was appointed as secretary.

S Alam and Farzana both listed their address as 2A Lincoln Road, #29-10 Park Infinia At Wee Nam, Singapore. The office address of Canali Logistics is 10 Collyer Quay, #10-01, Ocean Financial Centre, Singapore.

However, no office under this name was found in the Ocean Financial Centre when this reporter visited.

With Canali Logistics, S Alam purchased retail space of 27,179 sq-ft in 2014 – all on the first two levels of Centrium Square located in the Little India district, near the popular shopping market Mustafa Centre.

The construction of the 19-storey building was completed in 2020, and the Ocean Financial Centre directorate has 49 units on the first two levels of the market, the reporter confirmed after visiting the property.

Grand Imperial Hotel

S Alam also acquired Hotel Grand Chancellor on Belilios Road, also in Little India, through the Grand Imperial Hotel company in 2015. This hotel was rebranded as Hilton Garden Inn.

S Alam, his wife, is the director, and Thajudeen Nasirudeen is the secretary of this company, according to the ACRA document.

Wilkinson International is the shareholder of the company, holding 3.8 crore shares worth S$38 million, equivalent to Tk340 crore at current dollar prices.

The office address of Canali Logistics is also used for the Grand Imperial Hotel company.

S Alam and his wife updated their home address in 2019 in the company document to show 3 Jalan Merlimau, Singapore.

Toledo International

S Alam owns Holiday Inn Express Singapore Serangoon in Jalan Besar, which he bought through Toledo International.

This company was registered in Singapore in 2016, issuing 1 crore shares worth S$10 million, equivalent to Tk90 crore. The financial transactions of this company are also shown with UOB Bank in Singapore.

Thajudeen Nasirudeen is also the secretary of this company, and Toledo Ventures Limited holds all the shares of this company. The address of Toledo Ventures is listed in the British Virgin Islands.

The Business Standard traced S Alam’s involvement with Toledo International, as he used the Toledo office as his personal office located at 105 Cecil Street, #06-01, The Octagon, Singapore.

When visiting the office, The Octagon’s receptionist confirmed that the Toledo office is on the sixth floor and that S Alam used to come to this office regularly. Many Bangladeshis also came to visit him. However, S Alam has not been in this office for the last 3-4 months, as he has another office.

This reporter found the office to be empty. In a two-unit building, one unit is the Toledo office on the floor. When this reporter rang the doorbell at this office, a woman came out from another office and informed that S Alam has not been coming to the office for a few months, as he is abroad now.

This reporter also showed her Masud’s photo to confirm if he is the same man. The woman confirmed it.

Canopus II

S Alam acquired Ibis Novena hotel in the Novena area in Singapore in 2019 through another hotel company, Canopus II, which is located in the office of Canali Logistics.

Alpha Investment Partners sold the 241-room hotel through an off-market transaction.

S Alam acquired the freehold property in Singapore’s heartland region for just over S$705,000 per room of the 241-room hotel, as first reported by Singapore’s Business Times.

This reporter also communicated with the reporter of this Business Times report and confirmed the acquisition of the hotel by S Alam.

How S Alam gagged media and stop investigation of his wealth abroad

The Criminal Investigation Department (CID) has launched an inquiry into the alleged laundering of Tk1,13,245 crore (approximately USD 10.7 billion) abroad by S Alam and his associates.

The Financial Crimes Unit of the CID initiated the investigation under the Money Laundering Prevention Act, 2012, on 1 September following the ousting of Sheikh Hasina’s 16-year-long administration on 5 August.

Previously, during the Hasina regime, S Alam halted the investigation into his wealth abroad and gagged the media through a court order to ban reporting on money laundering by his group, lording his influence over the judiciary system during the Hasina regime.

For instance, in a suo motu ruling, the High Court on 6 August 2023 ordered an investigation into the accusations against S Alam and his wife Farzana for unapproved foreign investments or money transfers.

The order followed a media report on the laundering of about $1 billion by S Alam.

The bench, led by Justice Md Nazrul Islam Talukder and Justice Khizir Hayat, directed the Bangladesh Anti-Corruption Commission (ACC) and the Bangladesh Financial Intelligence Unit (BFIU) to conduct a thorough inquiry into the matter and submit a comprehensive report within two months from 6 August 2023.

A week after the order, a legal notice was sent to the government, the editors of four national newspapers, and eight journalists from these dailies on 12 August 2023 in relation to reports published about S Alam and his Group, and a loan given by Islami Bank.

The notice was served on Inam Ahmed, editor of The Business Standard, and reporters Jebun Nesa Alo and Sakhawat Prince for the report “How a 24-year-old greenhorn is ‘blessed’ with a Tk900cr loan” published on 27 November 2022.

Similar notices were sent to Mahfuz Anam, editor and publisher of The Daily Star, its then executive editor Syed Ashfaqul Haque, and journalists Partha Partim Bhattacharya and Zyma Islam. These were in response to the reports “Tk 7,246 crore loans to 9 firms: BB probing breach of rules at Islami Bank” (29 November 2022) and “S Alam’s Aladdin’s lamp” (4 August 2023).

Prothom Alo’s editor and publisher Matiur Rahman, and journalist Sanaullah Sakib also received notices for the report “Islami Bank e Bhayangkar November” (24 November 2022).

The legal notice was also sent to Nurul Kabir, editor of the New Age, and reporter Mostafizur Rahman for a report titled “S Alam Group lifts Tk30,000cr loans from IBBL alone” published in the daily on 30 November 2022.

The notice warned that a writ petition would be filed with the High Court seeking necessary remedies.

Ruining banks

S Alam allegedly laundered Tk95,000 crore abroad after obtaining loans from eight Bangladeshi banks under various names, using false claims of export-import businesses and investments.

Eight banks and two non-bank financial institutions in the country were under S Alam Group’s control until the fall of Hasina’s regime.

Obayed Ullah Al Masud, the newly appointed Chairman of Islami Bank following the board’s reconstruction in August, stated that S Alam Group took more than half of the total loans disbursed by the bank.

The bank disbursed a total of Tk1.74 lakh crore as of June this year, of which at least Tk90,000 crore was taken by S Alam Group, according to the new chairman’s statement.

Islami Bank, the largest private commercial bank, was allegedly taken over by S Alam Group at gunpoint in 2017.

The amount of loans taken from only Islami Bank reflects the gravity of corruption in other banks conducted by the business group. The once-healthy Islami Bank fell into a severe liquidity crisis after being taken over by S Alam Group due to significant loan corruption.