Beximco seeks lifeline with 5-point plan to safeguard business, jobs

Beximco Group, a leading conglomerate in the country, has submitted a five-point proposal to the government aimed at ensuring the continuity of its business operations, particularly in its export-oriented garment and textile sectors, and safeguarding the jobs of 40,000 employees.

At the top of its demands is the transfer of all outstanding dues as of 31 August 2024 into an interest-free block account. The group has requested that the interim government and its lender, Janata Bank, to allow a repayment period of 10 years for this liability, with a two-year moratorium.

Beximco Managing Director Osman Kaiser Chowdhury has sent the proposal to the Janata Bank managing director for restoring its export-related credit facility. The same proposal letter has also been sent to the advisers of finance, home affairs, industries, labour and employment ministries and the Bangladesh Bank governor.

Beximco’s other demands include the establishment of necessary back-to-back letters of credit (LCs) against export LCs already received and to be received now onwards, providing a bill discounting facility against the local supply of fabric and accessories at a 10% margin, providing a packing credit facility at the rate of 15% against each export LC or order and releasing maturity amount (after adjusting interest and charges) from the related or respective export proceeds.

Beximco said it is concerned about the payment of worker wages for September which is expected to be Tk65 crore and requested to deduct and build-up this amount from their export proceeds that have already been received and the export proceeds to be received up to 6 October this year.

“To pay the wages of our workers for August, Tk69.05 crore is needed. We have got a Tk55 crore loan from Janata Bank and added the remaining amount ourselves which was earmarked for clearance of imported raw materials.” the letter mentioned.

In the letter, Beximco wrote that to combat the present state, there might be only two possible ways. First, downsizing manpower and reducing other relevant expenditures so that they can be met by the business itself. Second, retain the manpower especially the workers until business comes back to the breakeven level.

“As a professional team, we are flagging the issues to you since we can’t afford to take either of the decisions especially when the sponsors are not available. But, we hope that business will turn around and be back to the breakeven point by January 2025 in case we start delivering shipments right now and continue smoothly,” reads the letter.

Beximco has assured that it will be able to repay the proposed fresh loans from the export collections/proceeds within 120-150 days from the date of its disbursement.

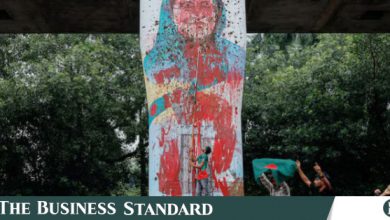

The letter reads, “We have not received any credit facility after May 14, 2024 from your bank. Besides, on the 5th August, 2024 the change of government in the country through the student movement and the situation that arose, our export-oriented goods and clothing industries and all related infrastructures were extensively looted and set on fire by miscreants.

“As a result we have no working capital left with which we can carry out further export activities. Customers have already started moving their orders from us to other alternative destinations and we have now fewer orders compared to our capacity.

“We have worked out our sales forecast and the cash inflow up till December 2024 and found cash deficit to meet expenditure (worker wages, officers’ salary, power, logistic and administrative) at existing level. In case the situation continues; we will also lose our customers forever.”

The Bangladesh Financial Intelligence Unit (BFIU) on 28 August ordered all banks to freeze accounts of Salman F Rahman, co-founder and vice chairman of Beximco Group.

At the same time, the accounts of Salman’s wife, their son Ahmed Shayan Fazlur Rahman and daughter-in-law Shazreh Rahman were also frozen.

According to a BFIU letter, all transactions through the frozen personal bank accounts will be halted. No transactions will occur in these accounts for the next 30 days.