Outstanding external debt surges to $69.66 billion

Foreign loan repayments will reach $5 billion within the next two years, says ERD

Inforgraph: TBS

“>

Inforgraph: TBS

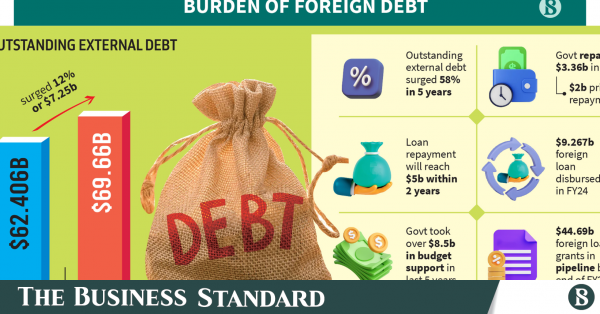

Bangladesh’s outstanding external debt surged to $69.66 billion by the end of FY24, driven by increased loan disbursements for mega-projects and budget support, marking an increase of $7.25 billion or 11.6% compared to the previous fiscal year, according to the Economic Relations Division (ERD).

Over the past five years, the country’s outstanding external debt surged 58%. It reached $62.406 billion by the end of FY23, as per the ERD.

ERD officials indicate that the rising outstanding external debt will increase the pressure of loan repayment.

In the last financial year, the government repaid $3.36 billion in foreign loans, with over $2 billion of this amount going toward the principal.

The ERD projects that foreign loan repayments will reach $5 billion within the next two years.

Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, told TBS, “As our debt continues to rise, so does the burden of repayment. In the next two to three years, loan repayments are expected to reach $5 billion-$6 billion.”

“Without an increase in revenue collection and foreign exchange supply, the economy could face significant strain due to this repayment pressure,” he added.

The ERD’s preliminary outlook released last Sunday reported $9.267 billion in foreign loan disbursements for FY24, a figure the division anticipates may rise in the final assessment due to potential adjustments in data from development partners.

Consequently, the outstanding debt could also increase.

According to ERD officials, various megaprojects, including the Rooppur Nuclear Power Plant Project, Metrorail MRT-6, Padma Rail Link, Karnaphuli Tunnel, and the 3rd Terminal of Hazrat Shahjalal Airport, have been completed or are in the final stages of implementation.

As a result, loan disbursements from development partners for these projects have increased, leading to a rise in outstanding debts, they say.

Additionally, the government has secured budget support due to the economic situation caused by the Covid-19 pandemic and the Russia-Ukraine war, further contributing to the increase in outstanding external debt.

According to ERD data, the government has secured over $8.5 billion in budget support over the past five years, with funds typically disbursed as soon as the loan agreement is signed.

Since independence, Bangladesh has received more than $13 billion in budget support from development partners, with over 60% of this amount taken to address the economic crises caused by the Covid-19 pandemic and the Ukraine-Russia war.

The latest outlook accounts for loans taken by the government through the ERD for various development projects and to meet budget deficits from development partners. However, it does not include high-interest buyer’s credit or commercial loans taken by various government agencies. For instance, loans obtained by the government from abroad to purchase fuel oil are not included in this calculation.

Stakeholders expressed concern over the increasing reliance on bilateral development loans, which typically demand repayment within 3 to 15 years, unlike multilateral loans. This shorter repayment period accelerates the debt servicing burden.

Moreover, the requirement of upfront payments for bilateral loans increases their overall cost. Consequently, a rise in bilateral debt can intensify pressure on both the balance of payments and the government budget.

$44.69 billion in pipeline

Meanwhile, according to the ERD’s preliminary outlook, foreign loans and grants in the pipeline totaled $44.698 billion at the end of FY24, with most of this amount being debt. This is up from $43.837 billion at the end of FY23.