Stocks snap four-day rally | The Business Standard

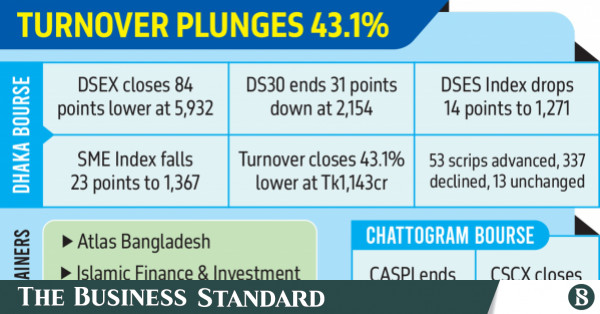

The DSE turnover plunged by 43.1% to Tk1,143 crore compared to Tk2,010 crore in the previous session.

Infographic: TBS

“>

Infographic: TBS

Stocks halted their rally, which had persisted for four trading sessions following the fall of the Sheikh Hasina government last week, as investors opted for profit-taking today.

The prime index DSEX of the Dhaka Stock Exchange (DSE) decreased by 84 points to settle at 5,932. The blue-chip index DS30 fell by 31 points to 2,154, and the Shariah-compliant stock index DSES dropped by 14 points to 1,271.

The DSE turnover plunged by 43.1% to Tk1,143 crore compared to Tk2,010 crore in the previous session.

Over the four consecutive trading sessions leading up to Sunday, the DSEX, the primary index of the DSE, gained 787 points. Additionally, the market’s turnover exceeded Tk2,000 crore, reflecting a positive reaction from investors.

Following a surge in political optimism, many blue-chip stocks that were previously undervalued became attractive to investors, significantly contributing to the rise in market indices.

In this context, some stocks with political backing saw steady price increases, while others experienced sharp declines.

On this day, the DSE indices opened with a downward trend. Despite attempts to rebound during the session, they failed to maintain positive momentum and closed with a sharp decline amid strong selling pressure.

Of the 403 issues traded on the country’s premier bourse, 53 advanced, 337 declined, and 13 remained unchanged.

Atlas Bangladesh topped the list of gainers, rising by 9.97% to Tk81.60, followed by Islamic Finance and Investment at 9.92%, Social Islami Bank at 9.80%, Pragati Life Insurance at 9.97%, and AB Bank at 9.09%.

Central Pharmaceuticals led the list of losers, followed by SBAC Bank, Bangas, Monno Ceramic Industries, and Beximco Pharmaceuticals Ltd.

Grameenphone, BRAC Bank, Techno Drugs, Robi Axiata PLC, and IFIC Bank were the most traded stocks on the Dhaka bourse.

EBL Securities noted in its daily market commentary that the rallying capital market faced a halt due to profit-booking sell-offs as investors partially offloaded their holdings to realise recent gains after the benchmark index reached a five-month high, spurred by a notable shift in investor sentiment.

The market experienced volatility right from the start of the session, with investors remaining active on both sides of the trading fence. Sellers ultimately dominated, pulling back the heated market, according to the commentary.

On the sectoral front, the bank sector led with the highest turnover at 24.0%, followed by pharma at 14.6% and telecom at 13.6%. Most sectors showed poor returns, with ceramics at 2.9%, services at 2.8%, and engineering at 2.7% experiencing the most corrections. However, telecom at 2.8% and life insurance at 1.0% showed slight positive returns.

The port city bourse, Chittagong Stock Exchange, also closed in the red. The selected indices (CSCX) and the All Share Price Index (CASPI) fell by 85.2 and 124.9 points, respectively.

The CSE turnover stood at Tk20.17 crore at the end of the session. Of the 269 issues traded, 68 advanced, 186 declined, and 15 remained unchanged.

On Monday, the DSE SME index increased by 23 points to settle at 1,367. The turnover of the board was Tk10.78 crore at the end of the session. Only three stocks advanced, while 13 declined and three remained unchanged.