How S Alam, kins skimmed Tk10,000cr from Janata Bank

In the complex realm of finance, where numbers often defy logic, one might wonder: Can someone with a monthly income of Tk1 lakh or Tk2 lakh secure over Tk1,000 crore in bank loans? The answer, surprisingly, is yes.

There is an age-old adage in Bangladesh: “No uncle, no job.” In this context, Saiful Alam Masud, the chairman of S Alam Group, is the “uncle”.

Having a powerful figure like Saiful Alam as an uncle can open doors to immense financial resources for his relatives. What usually takes months for ordinary borrowers can be sped up to days for those with the right connections, leading to quick disbursement of large sums.

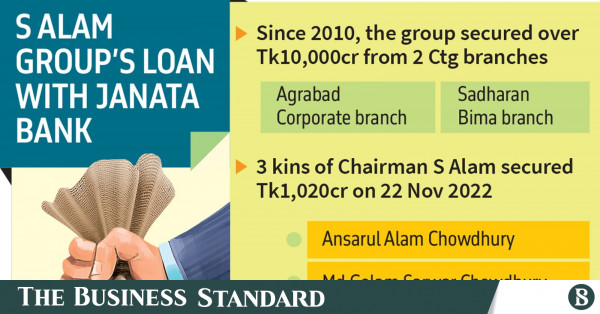

For instance, on 22 November 2022, three small traders from Chattogram, each reporting a modest monthly income of up to Tk2 lakh, secured a total of Tk1,020 crore in loans – Tk340 crore each – from Janata Bank’s Agrabad corporate branch and Sadharan Bima branch on the same day.

The whole process – from opening accounts to getting the amount disbursed – was done in less than three weeks and the borrowers were not even required to go to the bank branches in person.

According to bank records, seen by TBS, the three traders obtained the loan under the names of M/s Murad Enterprises, M/s Ansar Enterprises, and M/s Adil Enterprises.

TBS learned from bank officials and S Alam Group contacts that Md Golam Sarwar Chowdhury (Murad), proprietor of Murad Enterprises, is a nephew of Saiful Alam.

Ansarul Alam Chowdhury, owner of Ansar Enterprises, is Saiful Alam’s cousin and Mostan Billah Adil, owner of Adil Enterprises, is also his nephew.

When opening accounts at Janata Bank to obtain the loan, they claimed to be involved in trading corrugated tin and importing sugar and edible oil in Khatunganj, Chattogram.

However, a search of the NBR’s ASYCUDA database by officials found no records of imports by these companies, and they are also largely unknown among traders in the Khatunganj market.

Records reveal that they opened accounts with Janata Bank on 3 November 2022. Within a few days, on 6 and 7 November, they established FDRs totalling Tk3,500 crore across at least 20 branches of First Security Islami Bank and Union Bank in Dhaka and Chattogram.

On 17 November, they submitted these FDRs when applying for a one-year loan from Janata Bank.

In less than a week of the application, the bank’s Managing Director Abdus Salam Azad approved the loans.

Nurul Mostafa, who was the deputy general manager of Janata Bank at that time and in charge of the Agrabad corporate branch, told TBS that the loans were sanctioned at the directives of the bank’s higher authorities.

Several Janata Bank officials, wishing not to be named, told TBS that the bank’s MD Abdus Salam met with the S Alam Group chairman in Singapore before approving the loan, allegedly in return for a hefty commission.

Abdus Salam is still the MD of Janata Bank. When contacted over phone for comments, he did not answer.

Officials questioned the legitimacy of these FDRs, raising several concerns: how could small trading companies accumulate such large funds? If they did, why would they apply for high-interest loans while keeping money in FDRs at banks?

“Throughout the entire process – opening accounts, submitting loan proposals, securing approval, and disbursement – these three borrowers never visited the bank,” said a senior officer of Janata Bank, speaking anonymously.

“Instead, Abu Yusuf Md Mostofa, a former officer of Janata Bank now with S Alam Group, managed everything and visited both branches on their behalf,” he said.

He also said although the borrowers sought over Tk3,000 crore in loans, they received Tk1,020 crore as the remaining funds were not approved by the bank’s board following media attention.

Kins also obtained loans from other banks

TBS investigation reveals that in addition to taking loans from Janata Bank, Ansarul Alam Chowdhury, owner of Ansar Enterprises, secured a loan of Tk1,630 crore from the Islami Bank’s Chaktai branch.

When contacted, Ansarul initially denied taking a loan from Janata Bank but later acknowledged having an FDR against the loan.

“I don’t manage these matters personally. Please contact my company’s general manager for further details,” he said.

Murad, the owner of Murad Enterprises, secured a Tk1,000crore loan from Islami Bank Khatunganj branch, Tk120 crore from First Security Islami Bank Jubilee Road branch, Tk45 crore from Union Bank Khatunganj branch, and Tk37 crore from Global Islami Bank Anwar branch.

When contacted over the phone, Golam Sarwar Chowdhury Murad cut the call, citing busyness.

Adil, owner of Adil Enterprises, and his wife received a Tk2,773crore loan from Islami Bank Khatunganj branch.

Officials from the concerned banks told TBS that S Alam chief Saiful Alam Masud used his influence to arrange these loans for his relatives.

S Alam took Tk9,700cr from Janata in 14 years

In addition to the Tk1,020 crore granted to his relatives, S Alam Group itself has amassed nearly Tk9,700 crore in loans from Janata Bank’s Sadharan Bima branch over a span of 14 years, starting in 2010, a year after the Awami League took power, according to branch officials.

By 2015, the maximum loan amount extended to S Alam was Tk2,000 crore. However, following the Awami League’s victory in the 2014 elections, the branch has issued at least Tk7,000crore more in loans over the past nine years, reportedly under the influence of senior officials.

These loans were obtained under the names of S Alam Refined Sugar, S Alam Trading Company, S Alam Vegetable Oil, S Alam Super Edible Oil, S Alam Cold Rolled Steels Ltd, and other subsidiaries.

Janata Bank violated rules

To grant these huge sums of loans to S Alam Group, Janata Bank had to bend over backwards.

Janata Bank’s loans to S Alam Group exceeded regulatory limits by a significant margin. The bank extended over Tk10,000 crore to the group, violating the single borrower exposure limit of 25% of the bank’s capital. This amounted to 420% of Janata Bank’s total capital, which was Tk2,314 crore as of June 2024.

Although these loans were granted for importing goods, S Alam has failed to repay them. With special approval from the central bank, the loan was renewed annually.

On 25 June, Janata Bank’s board of directors even decided to approve a new loan facility for the group.

Efforts to contact Saiful Alam, chairman of S Alam Group, via his personal mobile phone were unsuccessful, as it was turned off, and WhatsApp calls went unanswered.