What is the true value of S Alam Group’s assets?

Following closely are the coal-fired power plants, valued at Tk21,092 crore, and the import and trading sector, with assets exceeding Tk20,000 crore

Infographic: TBS

“>

Infographic: TBS

The financial sector of Bangladesh has been rocked by revelations surrounding the controversial S Alam Group. The question of just how vast the group’s assets are has become a national talking point, especially in the wake of the interim government’s rise to power on 5 August, following the ousting of Sheikh Hasina’s 16-year-long administration.

Also, Dr Muhammad Yunus, now at the helm of the interim government, faces a growing outcry over reports that Saiful Alam Masud, chairman of S Alam Group, has syphoned off thousands of crores taken in loans from various banks.

Many of these loans, as reports suggest, were secured in the names of paper-only companies and entities linked to S Alam’s relatives and his hometown in Patia, Chattogram.

In response to the mounting concern, the newly appointed central bank governor, Dr Ahsan H Mansur, has assured that depositors will be compensated by liquidating S Alam’s assets.

To shed light on the scale of these assets, The Business Standard conducted an in-depth analysis of companies owned by S Alam Group.

According to information available on the group’s website, the total value of assets across nearly two dozen companies is estimated at around Tk1.5 lakh crore.

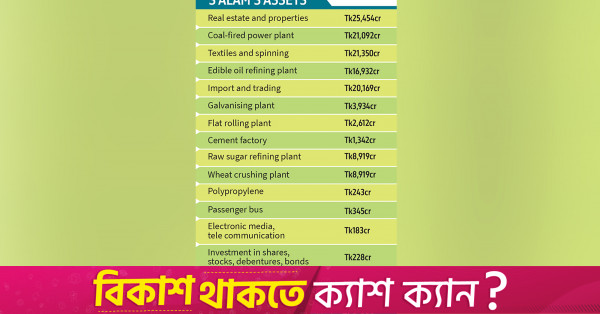

Among the group’s holdings, the real estate and properties sector commands the highest value, with assets worth Tk25,454 crore, comprising 28 land and building units primarily located in Dhaka and Chattogram.

Following closely are the coal-fired power plants, valued at Tk21,092 crore, and the import and trading sector, with assets exceeding Tk20,000 crore.

S Alam Group also has significant stakes in seven banks, one non-bank financial institution, and one insurance company, with combined assets estimated at approximately Tk4,000 crore.

However, industry experts assume that many of his assets are overvalued. For example, 28 units of land and buildings cannot be valued at over Tk25,000 crore.

Dr Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), said fraudsters often secure loans by providing false information and mortgaging assets with inflated valuations.

“I believe the S Alam Group’s assets, claimed to be worth around Tk1.5 lakh crore, are significantly overvalued, which is concerning,” she told TBS.

On the other hand, while accurate information about his bank and NBFI loans is unavailable, industry insiders estimate that S Alam Group’s total loans amount to at least Tk1,25,000 crore.