How a ‘gang of eight’ made crores from Beximco share manipulation

A group of investors executed circular trades in Beximco shares to create the appearance of active trading

Inforgraphic: TBS

“>

Inforgraphic: TBS

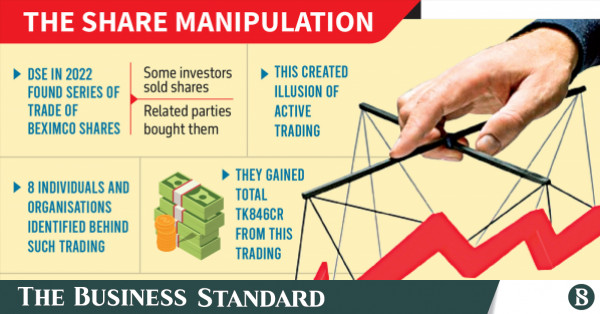

A group of eight investors earned Tk846 crore in realised and unrealised gains by manipulating the prices of Beximco shares in early 2022, reveals an investigation by the Dhaka Stock Exchange (DSE).

The investors – four individuals and four institutions – artificially inflated the share prices through a series of trades, mostly among themselves, to create a false perception of active trading – a violation of securities laws.

The DSE probe identifies these beneficiary investors: Abdur Rouf, Crescent Ltd, Mosfequr Rahman, Momtazur Rahman and their associates, Jupiter Business, Apollo Trading Ltd, Marjana Rahman, and Tradenext International Ltd.

During the investigation period of 2 January to 10 March 2022, the turnover value of Beximco shares was Tk4,406 crore, with over 70% of the total turnover executed by these eight investors across different client codes in several brokerage houses, according to the DSE report.

The group jointly made Tk319.74 crore in realised gains and another Tk526.48 crore in unrealised gains, as revealed by the investigation.

The country’s prime bourse submitted its investigation report to the Bangladesh Securities and Exchange Commission (BSEC) in late 2022, exposing gross manipulation of Beximco’s share prices and multiple violations of securities laws.

However, the report remained shelved for nearly two years, as the Shibli Rubayat-Ul Islam-led commission did not act on the investigation into share price manipulations involving a company owned by Salman F Rahman, the private industry and investment adviser to deposed prime minister Sheikh Hasina.

Companies involved in share trading include Crescent Ltd, Jupiter Business, Apollo Trading Ltd, and Tradenext International.

In 2022, Jupiter Business and Tradenext International secured seats on the board of Fareast Islami Life Insurance Company Limited after acquiring its shares. The two companies nominated senior executives from Beximco Group to represent them on the insurer’s board.

Tradenext International nominated Mostafa Zamanul Bahar, executive director of Beximco Group, while Jupiter Business recommended Ali Nawaz, chief financial officer of Beximco Pharmaceuticals; and Masum Mia, general manager of Beximco Textiles.

An official at Fareast Islami Life Insurance told TBS that although Beximco executives had previously served on the board of the company as an associate of Beximco, they no longer hold those positions. He added that the directors were withdrawn last July and a new board has since been formed.

On 14 March, the BSEC issued a warning letter to Tradenext International for violating securities laws. The letter mentioned the company’s address as Paramount Heights, 7th Floor, Box Culvert Road in Purana Paltan. However, during a visit this week on Wednesday, it could not be found at the address.

‘I know nothing’

Meanwhile, Abdur Rouf, who was involved in manipulation and violation of securities rules, claimed to be an employee of Beximco Group and that he worked as its Group Insurance Consultant.

Regarding the allegations of share manipulation, he said, “I don’t know anything about it. Only people within the company can provide more information on this matter.”

According to the BO accounts opened in the company’s name, Abdur Rouf is mentioned as a joint director of Crescent Ltd.

When asked about this, he said, “My signatures were taken on some documents at different times, but I don’t know anything about it.”

Ali Nawaz, who served on the board of Fareast Islami Life Insurance as the nominated representative of Jupiter Business, said, “I am not aware of whether Jupiter Business is an associate company of Beximco.”

When asked why he was nominated by Beximco, he explained, “Salman F Rahman told me that the government wants to improve the position of the insurance company. As part of this, he offered me the role of representative for Jupiter Business. Accordingly, I was nominated as a director.”

‘No action taken’

When asked about the situation, BSEC spokesperson Farhana Faruqui told TBS, “The issue of share manipulation was sent to the commission secretariat on 22 August 2023 to be discussed at a commission meeting.”

She added, “Usually if a matter is to be raised at a commission meeting, it is first sent to the secretariat which processes it and forwards it to the commission. However, the issue of Beximco’s share manipulation was not brought up at the commission meeting later, and as a result, no action has been taken.”

Shibli a chum to Salman

Around the time when these manipulations were taking place, Shibli Rubayat-Ul Islam helped Salman F Rahman by approving bonds to raise over Tk4,000 crore from the capital market, including both Sukuk and zero-coupon bonds.

Salman Rahman is now in police custody and Shibli recently resigned as BSEC chairman following the fall of Sheikh Hasina’s government on 5 August.

The new commission, led by Chairman Khondoker Rashed Maqsood, took charge on 18 August. At a press conference, Maqsood stated that the commission would not tolerate any irregularities or misconduct in the market like in the past.

The Business Standard tried to get more information from the investigation and inspection division of the BSEC but no one was willing to discuss Beximco.

An official who has been working in the department for over two years said, “During my tenure, I have not encountered any issues related to Beximco.”

How all that happened

According to the findings of the DSE, all the investors violated several subsections of Section 17 of the Securities and Exchange Ordinance 1969, which prohibits fraudulent activities in share trading. Violation of Section 17 is also considered a criminal offence.

Beneficiary investor Abdur Rouf was a client of United Securities, while Crescent Ltd was associated with Prime Bank Investment Ltd. Other investors, including Mosfequr Rahman, Momtazur Rahman and their associates, Jupiter Business, Apollo Trading, Marjana Rahman, and Tradenext International, were clients of Janata Capital and Investment. Some of these investors also held separate beneficiary owner (BO) accounts with Green Delta Securities, Beximco Securities, Sheltech Brokerage, and ICB Securities.

An official at the BSEC, speaking on condition of anonymity, told TBS, “The group of investors executed circular trades in Beximco shares, where some investors sold shares and others, related to them, bought shares in a series of trades to create the appearance of active trading.

“This is a serious violation and also a criminal offence. However, the previous commission did not pay attention to the DSE’s investigation.”

The DSE findings also showed that from 2 January to 10 March 2022, the turnover value of Beximco shares was Tk4,406 crore.

Crescent Ltd was a top buyer of Beximco shares. Abdur Rouf, director and joint operator of Crescent Ltd, actively participated in share trading with four BO accounts. The total trade volume of these five BO accounts was 33.25%.

Jupiter Business Ltd was the second top buyer. Mosfequr Rahman actively participated in trading with seven BO accounts. The group of eight investors jointly traded 24.61% of Beximco shares.

The same individuals also appear among the top sellers. On one hand, they bought shares, and on the other, they sold them – just to make the stock appear active.

The way they gained

Abdur Rouf’s average cost per share was Tk122.29, and his average selling price was Tk148.81, earning him Tk26.52 per share. Crescent Ltd’s average cost per share was Tk130.68, and it sold shares at Tk150.35, realising a gain of Tk19.67 per share.

Mosfequr Rahman, Momtazur Rahman, and their associates had an average cost of Tk113.29 per share and an average selling price of Tk151.67, resulting in a realised gain of Tk38.38 per share. Mosfequr Rahman’s per share capital gain was Tk59.31, with an average cost of Tk91.45 per share and an average selling price of Tk150.76.

Jupiter Business’s realised gain was Tk21.41 per share, with an average buying price of Tk132.34 and an average selling price of Tk153.75.

Marjana Rahman’s realised gain per share was Tk35.93, with an average buying price of Tk113.25 and an average selling price of Tk149.17.

Tradenext’s realised gain per unit was Tk26.34, with an average buying price of Tk134.34 and an average selling price of Tk160.68.

TBS has not verified whether the manipulators have made any changes to their unrealised gains of Tk 526.48 crore.

What investigation found

After examining the trading of Beximco shares, the DSE revealed that Abdur Rouf and Crescent Ltd violated the law by directly and indirectly affecting a series of transactions that created the appearance of active trading and the rising price of Beximco shares.

They also violated the law by executing trades that created a false and misleading appearance.

Crescent Ltd and Marjana Rahman further violated the law by conducting transactions on different dates that involved no change in beneficial ownership.

Mosfequr, Momtazur, and their associates, along with Marjana and Tradenext International, violated the law by effecting a series of transactions.

Additionally, Mosfequr, Momtazur, Jupiter Business, Apollo Trading Ltd, Marjana, and Tradenext International violated the law by creating a false and misleading appearance of active trading in securities.

Moreover, Mosfequr, Momtazur, and their associates violated acquisition and takeover rules by acquiring more than 10% of Beximco shares without adhering to the necessary legal procedures.

What rules they violated

Subsection (e) of Section 17 states: “No person shall do any act or practice, engage in a course of business, or omit to do any act which operates or would operate as a fraud, deceit, or manipulation upon any person, particularly by making any fictitious quotation or creating a false and misleading appearance of active trading in any securities.”

Additionally, the rules state that no person shall directly or indirectly affect a series of transactions in any securities that create the appearance of active trading, raise the price to induce its purchase by others or depress the price to induce its sale by others.

The ordinance regarding penalties states that whoever contravenes the provisions of Section 17 shall be punishable with imprisonment for a term that may extend to five years, or with a fine not less than Tk5 lakh, or with both.