Confidence Cement offers rights issue to meet rising investment costs

Infographic: TBS

“>

Infographic: TBS

Confidence Cement has announced a rights offering to raise funds and cover the increasing investment costs for its associate company – Confidence Cement Dhaka Limited.

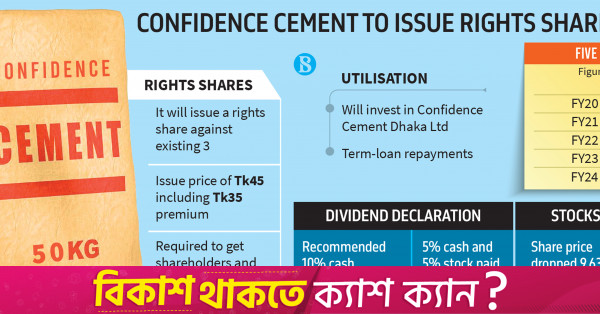

The Chattogram-based cement manufacturer, a concern of Confidence Group, plans to issue one rights share for every three existing shares at Tk45 each, including a Tk35 premium, according to a filing on the Dhaka Stock Exchange (DSE).

Company officials said the plan is to raise around Tk150 crore through the rights offering, which will be used to repay bank loans taken to meet the rising costs for the Dhaka plant.

Confidence Group has invested around Tk850 crore in building a new cement factory near the capital, aiming to expand its business and capture the Dhaka-centric cement market.

The new factory, Confidence Cement Dhaka, is being constructed at Danga in Palash Upazila of Narsingdi. With an annual production capacity of 18 lakh tonnes, the plant is expected to begin operations in the first quarter of next year, officials said.

Imran Karim, vice chairman of Confidence Cement, told The Business Standard that their initial plan was to invest Tk600 crore in the new factory, based on an estimated dollar exchange rate of Tk100-Tk105.

“However, with the rate surging to Tk120, we have spent an additional Tk250 crore. The increased cost has been managed through bank loans and our internal resources,” he said.

“To repay the high-cost bank loans, we have decided to offer rights shares to our shareholders, encouraging their participation in this effort,” Karim added.

Confidence Cement will now seek shareholder approval for the rights offer at its annual general meeting, after which it will approach the Bangladesh Securities and Exchange Commission for final consent.

Despite the rights announcement, the company’s shares dropped over 9%, closing at Tk73.20 apiece on Tuesday at the DSE.

Earlier in 2023, Confidence Cement had planned to raise Tk150 crore by issuing preference shares, but later abandoned the plan as it was deemed unsuitable, according to a company official.

Ready-mix business to be disposed

After halting production in February, Confidence Cement has now decided to dispose of its ready-mix concrete plant business due to disruptions in raw material imports caused by the foreign currency crisis, stagnation in domestic infrastructure development, and the imposition of new taxes.

Citing these factors, the cement manufacturer disclosed that these issues led to significant price hikes and a substantial decline in demand. The company stated that the capacity of its ready-mix concrete plant is 24 lakh CFT, and the plant is situated in South Patenga, Chattogram.

According to its annual reports, the cement plant contributed the majority of Confidence Cement’s total revenue, while the ready-mix plant contributed only a small portion.

Dividend declaration

The board of Confidence Cement has recommended paying a 10% cash dividend to its shareholders for the fiscal 2023-24.

To secure shareholder approval for the dividend, rights offer, and disposal of the ready-mix plant, the company will conduct its annual general meeting on 23 October. It has also set 30 September as the record date for the meeting.

Last year, the company’s consolidated profit jumped by 178%, reaching Tk75 crore compared to the previous year. At the end of the last fiscal year, its consolidated earnings per share were Tk8.73, up from Tk3.15 a year ago.

Confidence Cement’s vice chairman noted that the profit increased significantly due to strong earnings in the final quarter (April-June), which is the peak period for the cement business.