From clay banks to digital savings: bKash reforms money management

Over 2.7 million digital DPS accounts have been opened through bKash

Infographic: TBS

“>

Infographic: TBS

Embracing digital transformation, Shamsun Nahar, a housewife in Chattogram, now prefers to shop for daily essentials using digital payments, primarily through bKash. This shift led her to a new discovery in the bKash app.

Like many in her generation, Nahar tries to set aside some money from household expenses. She used to save spare cash in a clay piggy bank whenever possible.

However, a few months ago, while paying a bill through bKash, she noticed the new weekly DPS (Deposit Pension Scheme) option.

“It said anyone can start saving with as little as Tk250 a week! I knew right away this was perfect for me,” she said.

Without delay, she opened a weekly DPS with a 12-month term through the app from the comfort of her home.

Nahar, a mother of two young children, underscored future planning as her reason for starting the weekly DPS with a commercial bank through bKash. She intends to use the savings to renovate her children’s room next year, as their current beds will soon be too small.

This example shows how digital tools like the bKash app are empowering people to manage and grow their savings easily.

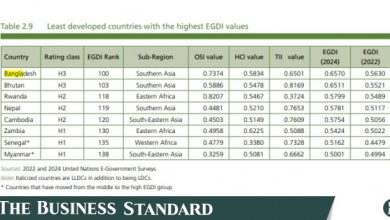

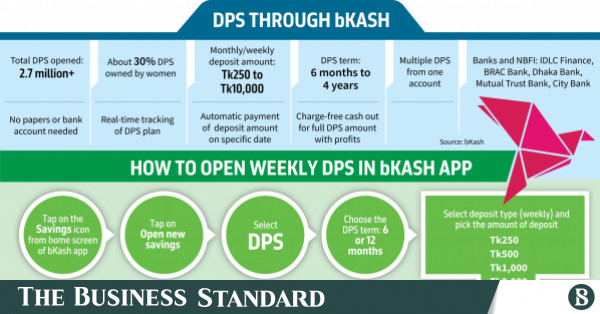

Since the introduction of monthly DPS in 2021, and the more recent weekly DPS, customers have opened over 2.7 million DPS accounts through bKash, collaborating with four commercial banks and a financial institution: BRAC Bank, Dhaka Bank, Mutual Trust Bank, City Bank, and IDLC Finance.

bKash introduced the short-term digital weekly DPS a few months ago, which is the first of its kind in Bangladesh.

The growing trend of opening DPS accounts through bKash indicates a shift towards digital adaptation in the financial sector, moving towards a cashless lifestyle.

While tech-savvy youngsters lead the charge, many others are also embracing this shift.

The weekly service allows people to save conveniently without needing a bank account. Customers can deposit between Tk250 and Tk5,000 per week with IDLC Finance, Dhaka Bank, or BRAC Bank. The weekly savings tenure can be set for 6 or 12 months.

The app’s user-friendly interface and the ability to compare interest rates offered by different banks make opening a savings account quick and easy, anytime and anywhere. This innovative approach has built trust and confidence in digital savings across various demographics.

Opening a weekly DPS with bKash

To open a weekly DPS account on bKash, users can follow a few simple steps. After tapping on the “Savings” icon and selecting “Open New Savings,” users choose “DPS” and provide the reason for opening the account. They can then select a term of 06 or 12 months, choose “weekly” as the deposit type, and specify the deposit amount.

Next, users select a bank or financial institution from the available options and provide nominee details. They then review the deposit details, agree to the terms and conditions, and enter their bKash PIN to complete the process.

Upon successful application, bKash and the selected bank or financial institution will send confirmation messages.

Notably, multiple DPS accounts can be opened from a single bKash account.

bKash automatically deposits installments from the user’s account to the DPS account on the specified date, ensuring there is sufficient balance. Upon maturity, the total amount, including interest, is transferred back to the bKash account. Customers can withdraw funds from agent points without charges.

To close a DPS before maturity, users can do so through the bKash app.

Due to its user-friendly interface and paperless process, bKash has attracted a diverse range of users, including small entrepreneurs, daily wage earners, job holders, farmers, housewives, students, and senior citizens.

bKash empowers these individuals to save seamlessly with banks and financial institutions, contributing to a more inclusive and digitally-driven financial landscape in Bangladesh.