Bangladesh needs $1.52b to keep fertiliser supply steady till March

$179m is urgently required to clear outstanding import bills

Infographic: TBS

“>

Infographic: TBS

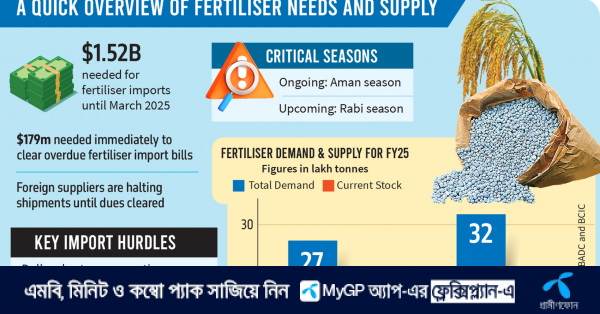

To ensure an uninterrupted supply of fertiliser for the ongoing Aman season and the upcoming Rabi crop season, $1.52 billion in fertiliser imports will be required by March, according to the agriculture and industries ministries.

The two ministries have also urgently requested $179 million from the finance ministry to clear outstanding bills for previous fertiliser imports.

At an inter-ministerial meeting on 5 September, officials from the agriculture and industries ministries said foreign suppliers are refusing to continue shipments unless pending payments are settled.

The meeting, chaired by Finance Secretary Md Khairuzzaman Mozumder, revealed that the ongoing dollar shortage is hindering banks from opening letters of credit (LCs) for fertiliser imports.

The situation has been further complicated by the lack of LC confirmations from foreign banks, which is also impacting private-sector importers, as noted in the meeting minutes.

In response to these challenges, the agriculture ministry recently sent a letter to the finance ministry, highlighting a potential fertiliser supply crisis beginning in October.

The finance ministry then instructed the central bank to ensure the availability of dollars for fertiliser imports by providing liquidity support or similar measures to settle LC liabilities.

Besides, the central bank has said it will reduce LC margins to more manageable levels for banks such as Islami Bank and others.

In a summary sent to Finance Adviser Salehuddin Ahmed last week, the finance division said, “The Bangladesh Agricultural Development Corporation (BADC) currently owes $80 million in import bills and shipping charges for DAP and MOP fertilisers from Saudi Arabia, Morocco, China, and Canada.”

“Delays in paying bills have led foreign exporters to cancel scheduled shipments. As a result, around six lakh tonnes of fertiliser could not be imported in the last three months,” it added.

The BADC manages the supply of non-urea fertilisers, while the Bangladesh Chemical Industries Corporation (BCIC) oversees urea fertiliser distribution.

According to the two corporations, Bangladesh’s urea fertiliser demand for the current fiscal year is 27 lakh tonnes, while the current stock stands at 5.70 lakh tonnes. For non-urea fertilisers (TSP, DAP, MOP), the demand is 32 lakh tonnes, with a current stock of 11.23 lakh tonnes.

Dollar shortage hits fertiliser supply

The crisis in fertiliser imports began when the previous government halted the supply of dollars from reserves. Since the interim government took office, Finance Adviser Salehuddin Ahmed has directed the relevant authorities to resolve the issue.

BADC Chairman Abdullah Sazzad at the meeting stated that various foreign suppliers are refusing to provide fertilisers due to outstanding payments.

“The dollar shortage has also led to issues with LC opening in the private sector, with Sonali Bank suspending LC openings and Islami Bank requiring a 100% margin,” he added.

He mentioned that although Janata Bank and Bangladesh Krishi Bank have taken steps to open LCs, they have been unable to secure the necessary additional confirmations from correspondent banks.

Nurun Nahar Chowdhury, additional secretary of the Ministry of Agriculture, said the Financial Institutions Division had previously held meetings with all banks to address the dollar shortage for fertiliser imports.

“Although all the banks had assured of providing the necessary dollars in that meeting, none have followed through on their commitments,” Nurun Nahar Chowdhury said.

According to the BADC, it currently has $117 million outstanding for previous fertiliser imports and an additional $700 million will be needed to cover imports until March.

BCIC Director Mohammad Shaheen Kamal said the organisation has outstanding bills of $62 million for urea fertiliser imports and $43 million for foreign loans related to the Ghorashal-Polash Urea Fertilizer Factory.

A further $672 million is needed for urea imports until March, along with $150 million for raw materials to produce TSP and DAP fertilisers.

Bangladesh Bank Additional Director Kazi Shaibal Siddiqui mentioned that the central bank has imposed a 100% margin for LCs opened with Islami Bank.

However, given the recent improvement in the dollar situation, Islami Bank could request the central bank to relax the margin requirements.

He also suggested that importers should not rely solely on Sonali Bank but consider opening LCs with other public and private banks with better dollar flow.