NBFIs loses 47,600 more depositors in 3 months

Corruption, irregularities, and a lack of good governance erode public trust in many NBFIs, central bank officials say

Infographics: TBS

“>

Infographics: TBS

The country’s non-bank financial institutions (NBFIs) lost 47,604 more depositors in the June quarter of this year, in continuation of the declining trend as the number has decreased every quarter since September 2022.

Central bank data shows that at the end of June 2021, the number of depositors in the NBFI sector was 7.62 lakh. However, within three months, by September of the same year, the number decreased by almost 5.5 lakh, reaching 2.10 lakh.

Following that, there was a trend of increasing depositors for about a year. However, since September 2022, the number of depositors has decreased every quarter.

Central bank officials attributed the decline to various factors, including corruption, irregularities, and a lack of good governance in many NBFIs, which has eroded public trust.

According to a Bangladesh Bank report, as of the end of June this year, the number of depositors in the country’s 35 NBFIs, including three government-owned ones, stood at 3.80 lakh, down from 4.27 lakh at the end of March.

Kyser Hamid, managing director and CEO of Bangladesh Finance And Investment Company (BD Finance), told TBS, “In our sector, there are many accounts that are DPS [Deposit Pension Scheme] or small deposits. The decline in these accounts could be the reason for the drop in the number of deposit accounts.”

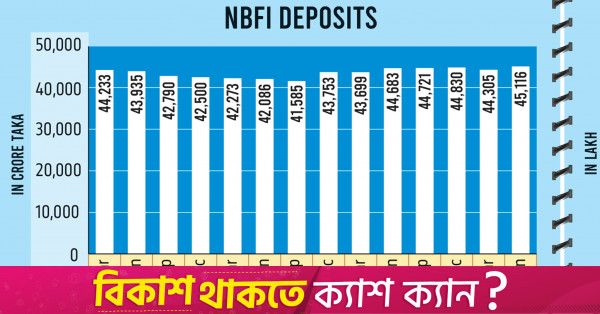

The central bank data shows that as of the end of June this year, the total deposits in NBFIs stood at Tk45,116 crore, which was 1% higher than the same quarter of the previous year. The deposit amount increased by Tk800 crore in the June quarter compared to the March quarter.

A senior official from the central bank said only a few select NBFIs are seeing an increase in deposits and customers. “However, the situation is not good for most institutions, leading customers to refrain from making new deposits there. Instead, they are withdrawing their existing deposits.”

He added, “Some institutions have even been unable to return customers’ money for several years. Additionally, with inflation rising significantly, many customers are withdrawing their deposits to meet their daily expenses.”

The official commented that most NBFIs are struggling due to irregularities in loan distribution and a lack of good governance.

Mominul Islam, founder of CLink Advisory and Former Managing Director & CEO of IPDC Finance, explained the significant change in customer numbers in 2021 to TBS, stating, “During my time at IPDC, several years ago, we conducted a DPS campaign in collaboration with a mobile financial service (MFS) provider.

“At that time, several lakh new DPS accounts were created. We expected that at least 10-15% of these customers would become permanent customers of IPDC. Unfortunately, that did not happen. The primary reason for this significant change in customer numbers occurs after such campaigns end.”

Commenting on the continuous deterioration of the NBFI sector due to the central bank’s overly conservative approach in the post-Covid period, the financial sector expert stated that the policies implemented by the Bangladesh Bank are making it difficult for even the institutions that are performing well to survive.

“To sustain the NBFI sector, these policies of the central bank should be reconsidered and changed,” said Mominul.

According to central bank data, as of the end of June this year, the number of accounts in NBFIs with deposits exceeding Tk1 crore reached 5,228, increasing by 24 from 5,204 at the end of March.