Nine banks face over Tk18,000cr in liquidity crisis

Bangladesh Bank Executive Director and spokesperson Husne Ara Shikha said, “As the account balances are changing daily, it’s difficult to provide bank-specific details. However, the combined deficit of these banks is around Tk18,000 crore.”

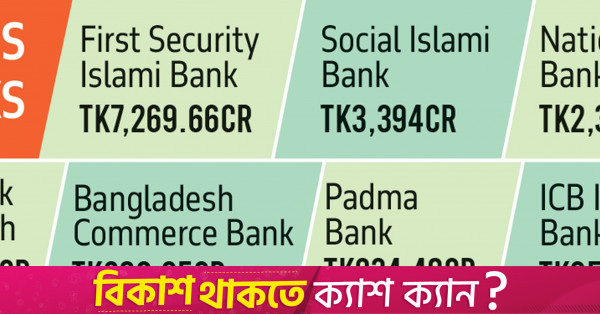

Infographics: TBS

“>

Infographics: TBS

At least nine private banks are grappling with severe liquidity crises, with the combined deficit exceeding Tk18,000 crore, according to data from the Bangladesh Bank.

Bangladesh Bank Executive Director and spokesperson Husne Ara Shikha said, “As the account balances are changing daily, it’s difficult to provide bank-specific details. However, the combined deficit of these banks is around Tk18,000 crore.”

However, according to sources in the central bank, First Security Islami Bank tops the list with the largest deficit of Tk7,269.66 crore, followed by Social Islami Bank at Tk3,394 crore and National Bank at Tk2,342 crore.

Other banks facing significant shortfalls include Union Bank’s Tk2,209.15 crore, Islami Bank Bangladesh’s Tk2,201.95 crore, Bangladesh Commerce Bank’s Tk 380.95 crore, and Global Islami Bank’s Tk 39.39 crore.

Additionally, Padma Bank and ICB Islami Bank face deficits of Tk234.48 crore and Tk95.42 crore, respectively, according to the central bank data.

Seven of these nine banks, recently freed from S Alam Group’s control, have requested Tk29,000 crore in liquidity support from the Bangladesh Bank to stabilise their operations.

So far, the central bank has signed guarantee agreements with five of these banks, while the remaining two are awaiting to finalise their agreements.

According to sources, once the agreement is finalised, struggling banks will be able to borrow from stronger banks, with the central bank acting as the guarantor.

According to sources, banks with negative current account balances cannot settle cheques through the real-time gross settlement (RTGS) or Bangladesh Automated Clearing House (BACH) systems.

However, banks affiliated with S Alam Group were allegedly able to settle cheques of any amount by depositing them in other banks through special arrangements with the Bangladesh Bank until restrictions were imposed on 14 August, capping cheque clearance limits at Tk1 crore.

According to sources, for nearly two years, these banks have been unable to maintain the required statutory liquidity. They have mortgaged all their assets to borrow from the central bank, leaving them with no collateral to secure further loans from the central or other banks.

Additionally, they are unable to pay the fines required for any shortfalls in CRR (Cash Reserve Ratio) and SLR (Statutory Liquidity Ratio).

Despite this, during the regime of the ousted Sheikh Hasina government, S Alam’s banks were allowed to continue transactions, even with negative balances in their current accounts, without any order to halt loan disbursement, the sources said.

However, after the interim government had taken charge, the Bangladesh Bank dissolved the boards of 11 banks, including seven of S Alam’s, and restructured them.

A large amount of loans had been taken out of these banks under various names during this period.

Meanwhile, Bangladesh Bank has signed guarantee agreements with five of the banks in crisis – Social Islami Bank, First Security Islami Bank, Union Bank, and Global Islami Bank, as well as National Bank.

These agreements will allow the banks to secure funds from the interbank market.

A central bank official explained that banks entering into these agreements will now be able to secure funds with board approval, which will then be sent to Bangladesh Bank for guarantee consideration. Based on this, Bangladesh Bank will authorise the amount each bank can borrow.

Governor Ahsan H Mansur recently stated in a press conference that the central bank will no longer print money to provide liquidity support but will instead facilitate such support through interbank money transfers. Following this announcement, seven banks applied for guarantees from the central bank.